Breakage and Theft Insurance

In case of an accidental breakage or theft, we will repair your product, exchange it for a new one, or issue a credit note.

- The insurance covers the product at home, at work or while traveling, anywhere in the world.

- We will handle the entire insurance claim for you, all you have to do is to report the damage to us.

- New terms and conditions with minimum exception: in the first half of 2022, we resolved 94% of all insurance claims in favour of the customer in cooperation with the insurance company.

How does this service help customers?

-

iPhone SE 128GB

iPhone SE 128GB

- The customer purchased a phone worth €472.

- They also purchased Breakage and Theft Insurance for their new phone.

- The customer accidentally dropped the phone on the ground, breaking the display.

- Thanks to the insurance, the customer was entitled to compensation for the repair in the amount of €290 (61% of the purchase price).

-

MacBook Air 13" Retina CZ Gold 2020

MacBook Air 13" Retina CZ Gold 2020

- The customer purchased an Apple laptop for €1107.

- They also purchased Breakage and Theft Insurance for their new laptop.

- The laptop was knocked over, cracking the screen.

- Thanks to the insurance, the customer was entitled to compensation for the repair in the amount of €441 (40% of the purchase price).

-

LG F4DT408AIDD Washer Dryer

LG F4DT408AIDD Washer Dryer

- The customer purchased a washer dryer worth €423.

- They also purchased Breakage and Theft Insurance.

- The washer dryer was stolen during a break-in at the customer's summer cottage.

- Thanks to the insurance, the customer received a credit note.

What makes it a worthwhile investment?

-

The customer purchased a service that provides security in contingency situations

-

Alza resolved the claim process and reimbursed the customer

-

The customer saved money on repairs

-

Breakage and Theft Insurance is a service worth investing in

How does it work?

-

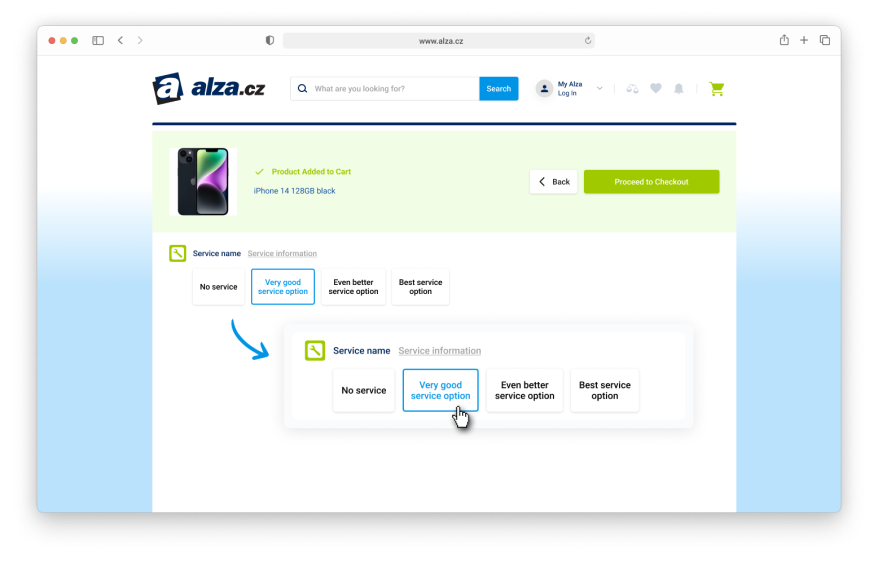

Get your breakage and theft insurance

Once you put your products in the Shopping Cart, select the Breakage and Theft Insurance option. You will activate the service by paying for it.

-

How do I redeem my insurance?

Report a malfunction, breakage or theft by calling 02 / 571 018 05. In case of theft, prepare the documents you got from the police.

-

Closing an insurance claim

We will settle your insurance claim as quickly as possible. Wait for our response.

The price of the service may vary – it is calculated based on the price of the insured product.

The insurance policy also includes coverage limitations and exclusions, which you can read in the policy terms and conditions available here.

As of 1 August 2021, we have fundamentally revised the insurance conditions — don't expect to see any small print exceptions for children or pets here.

Which goods are worth insuring the most?

We recommend purchasing the insurance especially for mobile phones, laptops, smart watches or TVs, mainly due to possible screen damage. It is also advisable to insure cameras due to frequent thefts.

How do I insure my devices?

FAQ

-

What cases are usually resolved in favour of the customer?

Our Breakage and Theft Insurance covers a wide range of different everyday scenarios. For example:

- - someone bumps into you, you are on the phone and the device slips out of your hand

- - your TV gets stolen from your apartment, house or cottage

- - you accidentally spill you drink on your laptop

- - a pickpocket steals your mobile phone on public transport

- - you accidentally drop your phone in the toilet (yes, this absolutely does happen)

- - somebody steals your camera while you are on holiday

- - your dog chews up your keyboard

- - your child knocks your tablet off the table

-

What claims will be rejected?

The situations listed below can also happen, but unfortunately they are not covered by our insurance:

- - your device gets stolen from an unlocked car

- - you forget your phone on the bar counter at the club

- - your laptop's battery starts to lose capacity quickly or becomes inflated

- - normal wear and tear and scratches on the display

- - your phone gets stolen while you are drinking alcohol

- - defects covered by the statutory warranty

For a full list of exclusions in our insurance policy, please refer to the Insurance Terms and Conditions.

-

How is the insurance claim processed?

In the event of damage, the product is first sent to an authorised service centre where we will carry out the diagnostics and identify repair options. Based on the price quotation (quantification of the repair costs) and the availability of spare parts, the insurance company's adjuster will decide whether the repair is cost-effective or the claim will be closed in some other manner (replacement or credit note).

-

How long can it take to resolve a claim?

We strive to settle each case within 45 days of receiving your device or the necessary documents from the police in the case of theft. This deadline is also met for the vast majority of cases. However, the statutory time limit for settling a claim is up to 90 days, and this is also stated in the insurance policy. The time limit for settling a claim starts from the moment the damaged product is handed over to us or all documents are delivered by the police.

-

How do I submit an insurance claim?

Report the defect, breakage, or theft here: 02 / 571 018 05 or by email to [email protected]. You can also report the your claim to an independent claims adjuster by emailing [email protected].

What do I need?

- - your purchase receipt number,

- - SN of the damaged product,

- - the cause of the damage (a precise description of the situation in which the product was damaged or stolen).

In case your device got stolen, please also submit the following:

- - an official notification that the case has been shelved,

- - an official police record (this may also be called a Protocol, Statement or Report),

- - IMEI blocking certificate (if it is a 3G/4G device).

The operator will note this information from you and provide you with a number under which the damage will be logged. Bring the damaged product in person to any of our stores as soon as possible.

-

Will I, as a VAT payer, be required to pay the VAT as in the case of car insurance?

Yes, if the case is resolved by repair. As a VAT payer, you will be required to pay a deductible of 10% of the purchase price of the product and you must also pay VAT on the repair price (this also applies to the replacement of the item at the service centre). However, as in other cases, it is possible to reclaim the VAT from the state.

-

Will you lend me a replacement device for the duration of the repair?

We do not currently provide replacement products while the claim is being resolved.

- Where can I find the previous versions of your insurance policy Terms & Conditions?

-

Do you disagree with the way your claim was settled?

If you disagree with the handling of your claim, we recommend you contact the independent claims adjuster RG Consulting Ltd. at [email protected]. You will receive a message about the initiation of the claim investigation. This can take up to 30 days, depending on the workload and complexity of the case.

Share it with your friends!

Are you interested in our offer? Don´t keep it to yourself! Share it with your friends.