Decentralized P2P exchange Bisq – How to buy and sell Bitcoin correctly? (GUIDE)

How to properly buy and sell bitcoin? The answer to a very simple and natural question may seem more complicated than you might expect. In Bitcoin, countless pitfalls await the average user, which he does not even realize until it is too late. And this is one of them. The vast majority of ways to buy and sell bitcoin available on the market completely ignore the reasons why Bitcoin was created and how it should be used. Phrases such as the need for a third party, a request for permission to make a transaction, and the need to trust someone have become commonplace, which is wrong. Very bad really. Fortunately, there is the Bisq project, a decentralized P2P exchange whose developers have not yet forgotten what Bitcoin is all about and what it is used for.

P2P exchange Bisq – Hot to buy and sell Bitcoin? (GUIDE) – ARTICLE CONTENT

- Do you buy, sell, but do you even know what you are doing?

- What is Bisq and how does it work?

- Bisq: installation and settings

- How is trading on Bisq?

- How to create a fiat account on Bisq?

- Limits of fiat accounts as protection against fraudsters

- Can I buy and sell altcoins at Bisq?

- Buying and selling on Bisq: Who is a maker and who is a taker?

- Solving Potential Trading Problems

- DAO and BSQ token

- #noKYConly or a little effort is worth it

- Conclusion - let's do things right, it's worth it

Do you buy, sell, but do you even know what you are doing?

If you buy or sell bitcoin in the usual way using a classic exchange such as Binance, Coinbase, Bitstamp and others, you take, consciously or unconsciously, a lot of risks. Some disadvantages are not serious and the advantages of this method of buying and selling can outweigh them. However, there are a number of disadvantages to critical issues that you, as a user, cannot eliminate, and if they do, these are irreversible issues that cannot be fixed.

Bitcoin has been released to the world for certain reasons, as a solution to specific problems. And that's just it. The problems that Bitcoin solves bring the classic buying and selling back into the game. What's more, at that moment, new risks begin to appear and accumulate, which it is not advisable to take voluntarily.

(De)centralization

Concepts such as centralization and decentralization have become largely buzzwords that are widely used in marketing and, popularly speaking, in the compilation of altcoins and various ICOs. Behind all this, however, lies a theme whose importance underscores the reasons why Bitcoin was created and how it works.

Bitcoin was created for the purpose of the financial sovereignty of an individual, which is in itself a very long and complex conversation. A simple, albeit very sophisticated system of full nodes, asymmetric cryptography, monetary economics and proof of work ensures precisely that financial sovereignty. However, this only applies if you use it all correctly. The ideal case would be the so-called closed circuit, where you would have the income in the bitcoin and all expenses as well. Unfortunately, we are not that far yet and it will take some time. And until then, we need to somehow link Bitcoin to the existing financial system.

Financial Sovereignty

Financial sovereignty is defined in particular by the fact that if you want to execute a transaction, you do not have to ask anyone for permission to execute the transaction. It may not seem important to you at first until you think about how your standard personal banking works. If you think in detail about the individual steps in a classic transaction, whether it is a payment by card, transfer from account to account or cash withdrawal from an ATM, a request for permission lurks at every step.

And it certainly happened to everyone that it was not possible to withdraw from an ATM or pay by card at the store. It could go for purely technical reasons, such as internet connection failures or lack of banknotes in ATMs, but the point here is that you have with you personally could not do anything. Authorization to execute a transaction is thus not just a simple YES / NO to a third party, but is usually part of a centralized system that is dependent on other parts that depend on other very complex parts and systems. And each of them can fail at any time across time and space, rejecting your transaction request.

Do you use your own full node? Without it, you can forget about financial sovereignty and true transactional freedom. And if the majority do not use full nodes, Bitcoin is doomed to fail.

If you do not know what this is about, or you do not know the reasons for using your full node, complete the education in our article: What is Bitcoin full node? (BITCOIN BASICS)

The above is just the tip of the iceberg, and if this explanation doesn't put you off the chair, it's probably not worth reading. You obviously don't need Bitcoin yet. Attentive readers have already realized that if you involve a third party in your use of Bitcoin, you do not have financial sovereignty. And that is the most valuable thing on Bitcoin as such.

Of course, with the request for permission comes the need for trust, or the need to trust a foreign third party. In the case of today's article, these are centralized exchanges. By the nature of Bitcoin, if you buy or sell in this way, you will never avoid the stage where you literally lose your bitcoins, or rather voluntarily transfer your ownership to someone else. Irreversibly and forever.

It is not possible without trust?

What role does the need for trust play here? The exchange has some reputation, a number of satisfied (and dissatisfied) users, may have a long tradition and may have a nice website. There are a number of factors that subconsciously tell the average user that this third party is trustworthy and it is not such a problem to trust it. Maybe not, but that doesn't change the purely technical fact that the moment you send your bitcoins to a third party, you have de facto lost them. You can't talk your way out of it, it's a clear fact. You can only hope that that trusted bitcoin company will return them to you if you ask for them. And it will do it in most cases, it has no reason not to. Until something happens.

And that's just it. Anything can happen. But if you don't ask anyone for permission to make a transaction, you don't need to trust anyone. If you accept the transaction and do not involve anyone else, you cannot be threatened by a third party failure.

The best known and most common are, of course, hacked third parties from whom someone else stole bitcoins. Lesser known, mostly neglected, and worse cases are those where a third party refuses to return "your" bitcoins. Again, there can be many reasons why this would happen. Most often you can violate some of their conditions, which are usually quite extensive, unclear and often change. To realize the seriousness of the problem, it is necessary to understand that exchanges also have their bosses. They have someone to answer to and before whom they have to bend the knee. They are states and regulators. And those third parties you trust don't play your game. They play someone else's game, according to foreign rules. And if they don't follow them, they will end up very badly

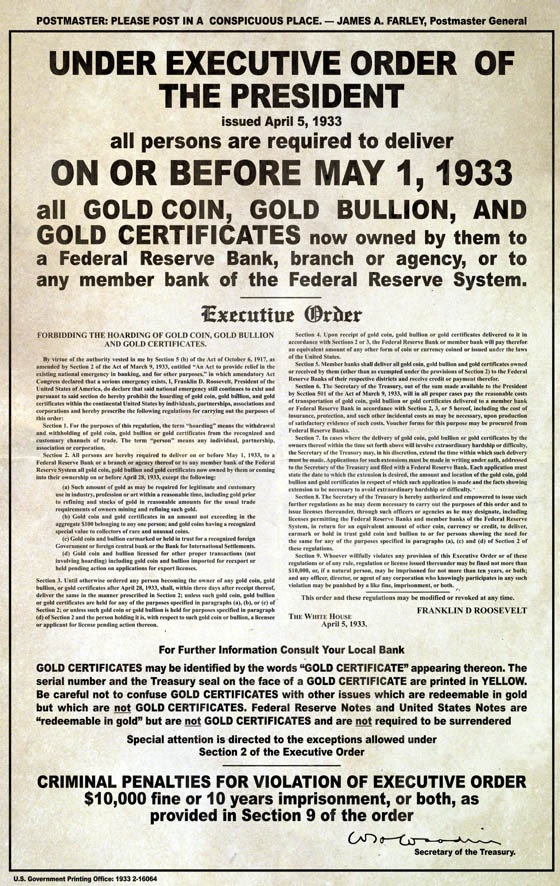

So if one day someone decides that the exchange has broken the rules, they will confiscate everything from it, including "your" bitcoins, which you believed the exchange would return to you if you asked them to. It is not a question of how likely it is to happen or when it will happen, but that it is purely technically possible. Have you ever heard of Executive Order 6102 of 1933 in the United States? Until 1974, the Americans were not allowed to own gold in the form of coins or gold bricks by order of the then president Franklin Delano Roosevelt. Then the owners were forced to sell the gold for 20.67 USD an ounce.

Do you think that will never happen with bitcoin? Maybe not, maybe it will. The important thing here is that this can again happen purely technically. Bitcoin, as it was designed, provided you use it properly, allows no one to take it from you, even if he stands on his head. If we go into detail, it can and probably would be a lot more complicated, but the other thing is important. If you are unlucky and "your" bitcoins are at the stock exchange operator at the moment of the impact of such a situation, then you are unlucky. The stock exchange or exchange office would probably return the fiat currency at a fixed exchange rate.

What is Bisq and how does it work?

The question of what Bisq is and how it works could be easily answered. Bisq is a way (protocol) to buy and sell bitcoin. And it works the way it should look. It is the complete opposite of the first and penultimate chapter of this article and the unfortunately already experienced paths that new users take and lose at the very beginning.

And now purely technically:

- Bisq is open-source. Anyone can read and verify the publicly available source code of Bisq and any subsequent changes.

- Bisq works on 2 of 2 multisig addresses, ie on the basis of smart contracts. As such, Bisq does not hold any BTC or other assets.

- Bisq uses a peer-to-peer network for communication, exclusively through Tor. There is no server or intermediary to attack and steal from.

- Bisq is by default SPV wallet, but you can and should use your own full node.

- Bisq uses bitcoin as its main currency. The disadvantage is that Bisq cannot be used without a small amount of bitcoin.

- Bisq has no access to data on stakeholders trading with each other.

- Bisq does not require any registration, because there is nowhere to register. Technically, this eliminates the possibility of data and identity theft. There is nothing to steal.

- Bisq is not a company, it has no registered office, employee or owner. The only structure is the Decentralized Autonomous Organization (DAO), which is not subject to any jurisdiction.

A brief description of Bitcoin:

Bitcoin as a technology is open source. Everyone can read its source code, including past and future changes. The Bitcoin system itself does not hold any bitcoins or other cryptocurrencies or fiat money. It uses a peer-to-peer network for all communication. Bitcoin does not run on any central server, there is no way to steal or hack it. Bitcoin itself has no data on the trades or the parties involved in the trade. Use of Bitcoin is not subject to any registration. No personal data is needed and what does not exist cannot be stolen. Bitcoin is just a "few" lines of well-designed code. It has no address and no one is responsible for it. And so there is no one who can slap Bitcoin, arrest, prosecute, convict, imprison, torture and blackmail Bitcoin. Does that sound familiar to you?

And in a little more detail:

- Download the Bisq software and run it.

- You set the payment methods (SEPA, Revolut, Face-to-Face, Western Union, etc.)

- You go through and choose from the bitcoin purchase offer.

- Send fiat currency to the seller’s bank account (depending on the type of payment).

- You will wait for confirmation from the recipient.

- Done, the bitcoins are yours, on your wallet.

All data communication is encrypted multiple times, and network traffic is anonymized using torification over the Tor network. No data on trade participants can be intercepted in any way. What is not stored anywhere or is encrypted cannot be misused in any way.

Most importantly, the entire process of trading and using Bisq does not require any identity verification. No ID and driver's licenses, passports, account statements or invoices from energy suppliers, and no photos of your face by default containing EXIF data about your geolocation in time and space. Nothing that anyone could steal somewhere and then sell on the dark market and otherwise misuse. Even better, no one will ever seize a server with data that they can use against you, because there is no such server or place. More in the next chapter. Let's finally try Bisq.

Bisq: installation and settings

If you are interested in what Bisq has to offer, let's take a look at the installation and detail the individual steps of how Bisq works. It's not difficult and anyone can do it. Therefore, if you, as a seasoned bitcoin and cryptocurrency expert, recommend someone to buy and sell, consider Bisq three times before sending a newcomer on a journey from which there is no return.

MacOS and Linux

Download the files for your platform, including the PGP signature, from the bisq.network website to verify the authenticity of the installer. The rest of the video will guide you through the verification and installation process.

Windows 10

For Windows 10, verifying the compliance of the installation file with the PGP signature is a bit more complicated, but the video will show you everything you need again. This is not non-standard, but purely good practice, which is good to learn and follow every time you install the software, if a signature is available. Especially in the cryptocurrency world, there is enough creativity to deceive inexperienced users and deprive them of their bitcoins.

Before you start using Bisq

Before you start with anything, you need to make basic security settings and private key backups, just like when creating a classic bitcoin wallet.

First you need to set a password for your Bisq wallet under the Account option in the main menu and then Wallet Password. I recommend using Password Manager. Ideally to be open-source again. A suitable combination is the hardware wallet Trezor, which, in addition to the safest way to store bitcoins, also offers a password manager.

The next step is the backup of the so-called seed, 12 words from which private and public keys are generated. Never store these words (called mnemonic phrase) on your computer, anywhere online (iCloud, Google Drive), and don't take pictures with your phone at all. A piece of paper stored in a safe place is ideal, or there are physically resistant methods, such as various Cryptosteels and similar variants.

The last and no less important step is to set up a backup, where Bisq will store all the necessary data. These contain encrypted information about your wallet, stores, accounts and identities that you will need to use Bisq. This data is stored locally and is not sent to any third party server, so it is very difficult to misuse it, such as selling it on a dark market.

How is trading on Bisq?

Bisq operates on the basis of offers and demands. In the following example you will see how the graphic trade between Alice and Bob from beginning to end.

In a fictional scenario, Bob is the one who wants to buy some bitcoins. On the other side is Alice, who throws in some fiat money and wants to sell some of her bitcoins. So Bob is a buyer, Alice is a seller. Bisq is a peer-to-peer exchange, so trading only takes place between Alice and Bob, so both must be online. Bob places a request to buy bitcoins. He would like a lower price below the current market value, he is patient and he does not mind waiting or having a PC turned on before there is someone who will sell him bitcoins under his conditions.

Bob sets the parameters of the offer to buy bitcoins. That is, how much BTC wants to buy, with what percentage difference above / below the market price and the equivalent of BTC in fiat currency, in this case in EUR. It is also possible to set the range of min. amounts demanded. Once Bob enters the parameters of the bitcoin offer, Bisq prompts Bob to pay a security fee (% of the amount traded), which incentivizes Bob to successfully complete the entire deal. If Bob completes the business, the security fee will be refunded. It is also necessary to pay a trade fee and a fee to the miners for mining the transaction.

Now, you may be wondering what the transaction is going to do when nothing like this is done when trading on a regular exchange. And that's the whole trick. On the classic centralized exchange, you really do not trade any bitcoins - there are no changes in the bitcoin blockchain. In contrast, the magic of Bisq lies in the so-called multisignature transactions or smart contracts. But let's go back to Alice.

As soon as Bob has finished listing his offer to buy BTC by sending the above-mentioned fees (in one transaction), Bob's offer will appear to Alice in her Bisq application. If Alice is interested in Bob's requested amount of BTC for the price and method of payment he has set, Alice can accept the offer. Bisq will call on Alice to enter into a transaction that includes: the amount traded, the security fee and the transaction fee for miners. Due to the nature of the multisignature transaction, Alice does not send any bitcoins to Bob at the moment, they go to the address of the smart contract and do not leave it until the conditions of the trade are met. Let's go back to Bob.

Once there are three confirmations of Alice's transaction on the bitcoin blockchain, Bisq will ask Bob to pay € for the bitcoins he wants to buy from Alice. In the scenario, Bob uses SEPA payment to Alice's euro account. As soon as Bob sends, he confirms the payment sent to Bisq, letting Alice know that she should expect money in her bank account. As soon as Alice notices the incoming payment, she will acknowledge receiving of € from Bob at Bisq and the deal is complete.

Alice confirms the incoming payment, thus fulfilling the conditions of the smart contract, and bitcoins from the multisignature address are automatically forwarded to Bob's Bisq's wallet. At the same time, a security fee is refunded to both participants for trouble-free compliance with the conditions and successful completion of the transaction.

How to create a fiat account on Bisq?

To successfully understand Bisq's overall design, we need to show how accounts and identities work here. Do not be afraid, it is not about your true identity, but about the so-called Tor identity. You can have an infinite number of them, without all of them being connected by a state document, an account statement, a photo of your face and God knows what.

In the illustrated video you can see three offers to buy BTC. The payment method of bids is SEPA to a German euro account. In order to accept this offer, you must also have a SEPA account created in your Bisq. Within Bisq, this is not a real bank account, again it is just a Tor identity, to which, for example, the reputation for successful business and the like are connected. But for this to work, you need to create this identity with the real data of your bank account, ie with the correct IBAN and BIC / SWIFT data. We'll talk right away why.

Under the Account tab in the menu, you will find the National Currency Accounts section, or fiat accounts in the national currency (CZK, EUR, CHF, etc.). You select Create New Account, select the SEPA payment method and fill in the true data about your bank account, from which you will pay for any purchased bitcoins or, conversely, accept payments for sold BTC. This data is stored only locally, it does not go to any Bisq server, because there is none.

Once you've created your account, you can look back at the bids to see if there's one that matches your payment method and the limits within which you can trade with your new account. The initial limit for SEPA payments is 0.01 BTC. All the individual accounts you create are independent of each other. They do not inherit raising limits or reputations for successful trades, so there is no connection between them. Let's now look at what the limits are, how they work and what they are for.

Limits of fiat accounts as protection against fraudsters

Limits on Bisq are not natural for a new user and, to put it mildly, it is not a user-friendly experience. You will probably find that you don't even have anything to buy, because there are some limits and signatures and together with low liquidity and a range of offers you will want to close Bisq again. Don't do it, hold on a second.

The basis of this system is basically the age of the account. You can find the current limits for your fiat account in the details where you first created it. Each payment method has different starting limits, which double after thirty days and again after sixty days. The age of the account itself only affects the limits of the amount of bitcoins sold. The difference is that if you sell bitcoins, there is no possibility, due to the nature of Bitcoin's design, to report about the payment in any way or to have it returned. However, this does not apply to traditional payments of fiat services, such as current bank accounts and SEPA payments.

If you want to increase your purchase limit for a specific fiat account, you must make the first successful purchase with a counterparty that has a so-called signed account older than thirty days. Thirty days after successfully completing a trade with a counterparty that also had a signed account that is more than 30 days old, your account will become signed. Thirty days after signing your account, you can start signing new, unsigned accounts with successful transactions.

The idea of this system is based on the fact that it takes some time and costs some effort to get a signed account, which you will not want to devalue with one petty fraud, where you would probably also commit bank fraud. With the mentioned financial methods based on the fiat system, there is the possibility of so-called chargebacks, where you can request a refund after signing the affidavit that you did not make the payment. This is a weakness of traditional banking and is basically the only possible form of fraud on Bisq.

If all this sounds too complicated, don't despair, all you have to do for the one just described, and therefore to get the signature of your account, is to successfully complete the trade with an offer that has a green ✅ symbol next to it. This is how offers from signed accounts with a signature older than thirty days are marked.

Can I buy and sell altcoins at Bisq?

Bisq is more or less a bitcoin affair, and until recently, developers accepted so-called pull requests for the integration of other altcoins, if the integration of the cryptocurrency was ensured by the respective developers. The mechanism for browsing / delisting has recently changed according to whether those interested in a specific market pay the necessary fees for the trial period. If the market is active during the trial period and generates sufficient fees, altcoin will remain listed.

The basis is again bitcoin and it is not possible to trade altcoins for fiat currency. Altcoins, including L-BTC (Liquid Bitcoin), are here in the position of fiat currencies, so they can only be exchanged for BTC and vice versa. If you want to buy a monero, you sell bitcoin, and if you want to sell a monero, you buy bitcoin. The only connection to Bisq between the worlds of cryptocurrencies and the obsolete fiat system is through Bitcoin.

The whole process of trading in altcoins then proceeds in the same way as in the previous chapter. Since this is an exchange of a cryptocurrency for a cryptocurrency, for which the chargeback is not possible by nature, there are no limits or no signing of accounts. This only applies to fiat accounts where this risk is present.

Buying and selling on Bisq: Who is a maker and who is a taker?

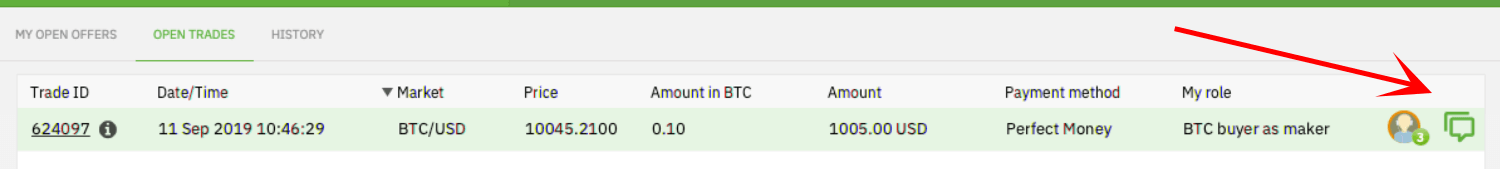

To make sure once again who is who on Bisq, who is selling and who is buying, let's look at who is a taker and who is a maker.

For beginners, this can be confusing terminology, so you'd better take a look at how an offer is made on Bisq (whether to buy or sell BTC). The one who creates the offer is a maker, which brings with it considerable benefits. The video shows how, as a maker, you create an offer to buy BTC for € on the Bisq market. In other words, you are looking for bitcoins, you are paying in euros. The disadvantage of being a maker is that you have to be online for potential opponents to see your offer.

The biggest advantage of being a maker, and therefore being the one who makes the offers, is that you determine your own rules according to which the trade will take place. The payment method is up to you and, most importantly, the security fee. By default, this is 10% of the traded amount, but the higher you give it, the lower the motivation for a potential fraudster to try something on you. An undeniable advantage is the setting of the price at which you are willing to buy BTC. You can set, for example, 75% of the price per bitcoin below the current market price. The last advantage of being a maker is about 80% lower trading fees.

From the taker's point of view, the trade is basically almost identical, you just choose as a taker (the one who takes) from the available offers set by the make-up. If an offer suits you, you can accept it and complete the deal as normal. Taker, unlike a maker, may not be online by nature.

But I'm sure you've wondered what happens when something goes wrong. What if the course of trade does not go as smoothly as it should? And what if the other party tries to deceive you?

Solving Potential Trading Problems

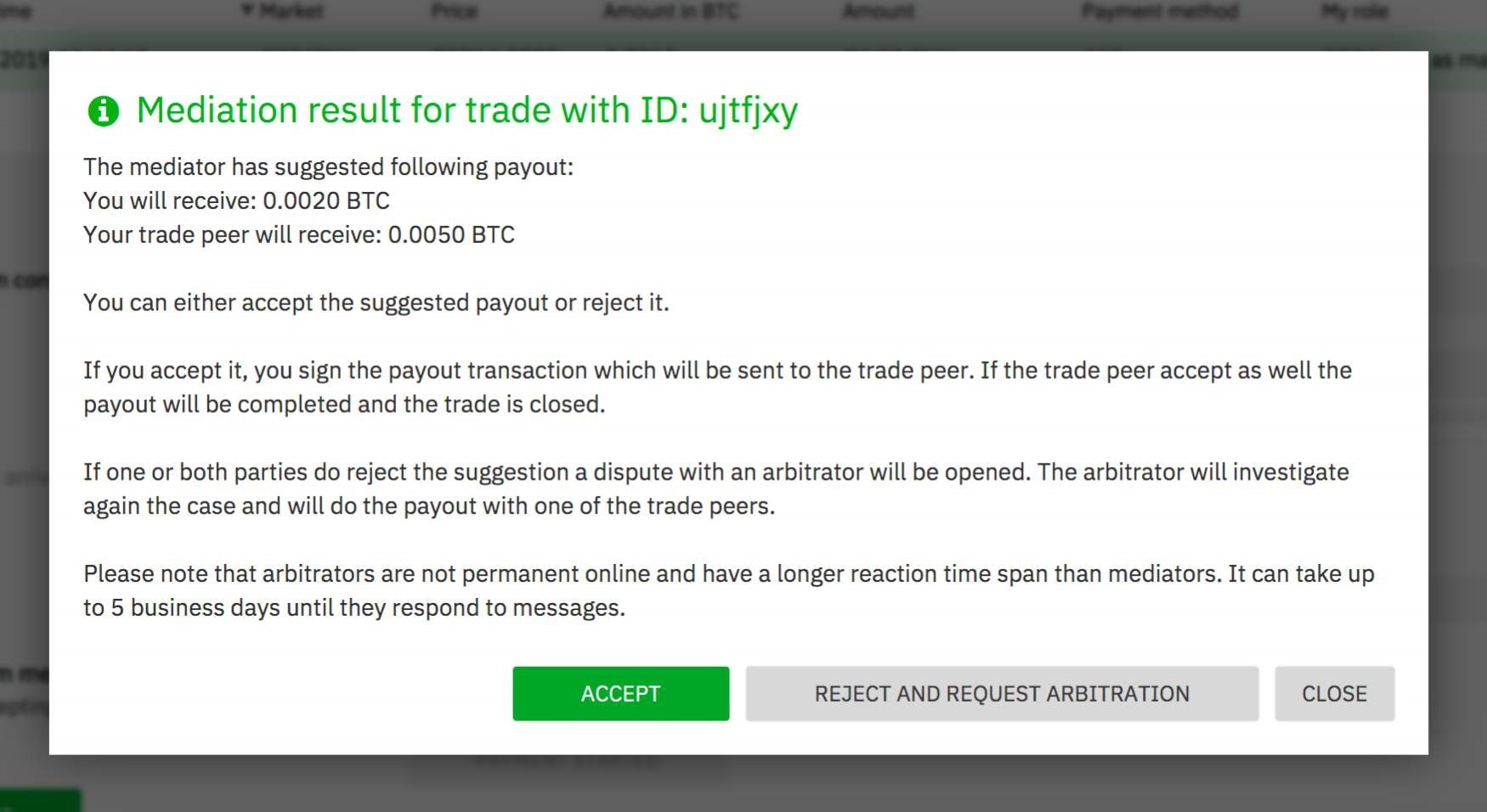

The Bisq trading system is designed and set up so that failure to complete a trade or attempted fraud does not pay off. Let's go back to chapter 4, Bob and Alice, and imagine that for some reason Alice didn't confirm the € receipt on her fiat account. The solution to a possible problem has three phases. Communication, mediation and arbitration.

Trading chat

Let's first assume that there is a good reason for Alice's inactivity. She doesn't have to cheat right away, so we'll use the encrypted chat feature. Bob leaves Alice a message asking why Alice still hasn't confirmed her receipt. Most likely, it was nothing from Alice and she didn't get to the PC for two days. He will check his fiat account, and if he sees the transaction, he will confirm the receipt of € directly in Bisq.

Of course, the banking systems are not perfect, so it may happen that Alice has not really received any money yet. Bob and Alice can agree to give it another few days. Bitcoins are locked in a multisignature time lock contract, so even if Alice cleverly waits, BTC will not automatically get back after the time lock expires. After the expiration of the time to complete the trade, the whole problem is solved by arbitration, but in the meantime there is still a mediation phase.

Mediation

Mediation is basically communication with the help of a mediator, someone from Bisq DAO. If there is no talk with Alice, Bob asks for support and a so-called mediator joins the chat, who tries to lead Alice and Bob to a viable solution. The mediator suggests resolving the dispute, and if Alice and Bob agree, the deal will be completed and Bob will immediately receive the purchased bitcoins. If both or only one party to the trade does not agree with the mediator's proposal, the arbitration phase begins.

Arbitration

The arbitration phase is the last step, which is intended as a final solution, which occurs only in extreme cases. The first case is where Alice does not respond to Bob's communication throughout the trade until the multisignature contract timeout expires. The second case is that one of the parties rejects the mediator's proposal and request arbitration directly.

In the eventual phase of arbitration, it is necessary to prove to the arbitrator (the person who handles the situation) that you are right. For example, a confirmation of the executed transaction verified by Bob’s bank, which will show all the necessary details of the transaction, may suffice. In extreme cases, arbitrator may request verification of Bob’s identity by video interview. As soon as the arbitrator deems it appropriate that the bitcoins really belong to Bob, he will personally compensate him for his bitcoins. The arbitrator will file a proposal with Bisq DAO for subsequent compensation for Bob's compensation. The bitcoins paid to Bob by the arbitrator will be returned from the Bisq donation address to which the BTCs automatically travel if the multisignature contract times out without the deal completing properly.

Remember the security deposit that both parties lock into a multisignature contract at the beginning of the trade? If the deal is not made by Alice, Alice's security fee will be Bob's compensation, which by default is 10% of the amount traded. This shows the advantage of being a maker, as the amount of the security fee depends on who creates the offer. The higher security fee thus incentivises both parties to act nice and complete the deal without any problems. And now let's take a look at the aforementioned Bisq DAO.

DAO and BSQ token

During the article, mention was made of DAO or the Decentralized Autonomous Organization. Among other things, Bisq also has its BSQ token, which should be an automatic redflag for careful readers. There are few reasons why a project should have its own token and a DAO structure can be one of them.

As already mentioned, Bisq as a project and essentially a mere piece of software code is not a for-profit company or a non-profit. It is not a company. It has no classic structure, no council of shareholders, CEO or executive. Nevertheless, Bisq needs to make most decisions as the usual structures just described. Will Bisq continue to integrate support for shitcoins? Who decides and how? And that's exactly what allows DAO. To sufficiently understand, it is necessary to know the three basic values of Bisq.

Why DAO and BSQ?

- User privacy

- User security

- Resistance to censorship

These three points require a simple but relatively difficult thing to do. This is to remove as many points as possible, which could serve for central control over the whole project or its parts. The Bisq network itself, as a decentralized protocol through which business takes place, is one thing. But the second thing is who creates Bisq. These are the so-called contributors or those who work on the source code and other parts of the whole system. Without DAO, all fees from completed trades go to one central point, as well as all decisions and the final word ends with the same person.

Bisq, as a DAO, grants credit to all contributors involved in the development and grants everyone the right to vote as part of the project reward. However, Bisq also recognizes its users, who should also have the right to vote, because without users, the work of contributors would be useless if no one used the software. For these reasons, a publicly traded BSQ token has been created, which contributors receive for work and users can purchase. The BSQ token can also be used to pay (cheaper) trading fees.

Let's say a contributor named Steve has put some time and effort into great documentation and would like to be rewarded for it. Clear and simple documentation is likely to facilitate the adoption of the Bisq network and help potential groping users. Steve values his work at 5,000 BSQ. Steve submits a proposal to Github, describing the details and benefits of his work, and establishes a proposal for the payment of a reward with reference to Github. Approximately once a month, all contributors, including users, have the opportunity to vote. If Steve's proposal is voted out, the Bisq network will generate new BSQ tokens, which will be credited to his account.

Bisq DAO uses a so-called bitcoin coloring system. Everyone who votes sends their vote along with a couple of satoshis. If Steve's proposal passes, the BSQ system will color these satoshis, which is instructed by the Bisq network to generate new BSQ tokens that are sent to Steve's BSQ account. This system and the coloring of the bitcoins have nothing to do with the bitcoin network and are therefore only visible in the Bisq network. BSQ tokens have no value in themselves nor are traded anywhere else. What will Steve do with them?

After all, there is someone in the Bisq network who would like to exchange BSQ tokens with Steve for real BTCs. Why? The reason is simple. There are two ways to pay fees for trades in the Bisq network. Through BTC and BSQ. And with BSQ tokens, the fees are, of course, many times lower, about 90%. To avoid unnecessary inflation, BSQ tokens are irretrievably destroyed at the time they are used to pay the fees.

The importance of Bisq DAO for traders

The main existence of BSQ is not out of extravagance to have its own token, the main point of the system is that users (traders) can pay contributors (developers) for work. If you understand the main message and idea of this article, which is not a guide on how to use Bisq, but why to use it, you certainly understand that the work that Bisq contributors are doing is priceless. Bisq's contributors are those who offer a safe alternative to buying and selling bitcoin to anyone who prefers it to the traditional way to hell.

As users - traders of the Bisq network, of course, you have the opportunity to participate in each voting cycle. But why should you do that? If you use Bisq and you care about the direction the future of development will take, you have your voice and you should use it. You can shape the future of the decentralized peer-to-peer protocol not only for yourself, but also for each new user and the next generation according to your best conscience.

Importance of Bisq DAO for contributors

It's hard to find a better feeling in the bitcoin ecosystem as an open-source developer than when someone rewards you for your work. Even if it's just for coffee. The well-known saying is: Where there is FOSS (free open-source), there is misery. And if you work on Bitcoin, it's doubly true, with a few exceptions.

The Bisq DAO and BSQ token is just at the beginning of its journey. In the long run, with the growing adoption and use of Bisq, the value of BSQ should grow in all respects, and at the same time, when the time is right, BSQ trading for BTC should be launched and vice versa. So far, BSQ tokens are good for lower fees and thanks for the work of contributors. But if Bisq is going in the right direction and is successful, it may be worthwhile for you, as potential contributors, to put your hand to the work and keep the BSQ.

Thus we have a finished theory of the use of Bisq and we can go for practice. It's simple, and once you finish your first trade, it won't make sense to go back to the dangerous, nonsensical nonsense we call centralized exchanges and exchange offices. For now, feel free to download and sync Bisq, but let's go to the last, albeit very unpleasant, most important topic of the whole article.

#noKYConly or a little effort is worth it

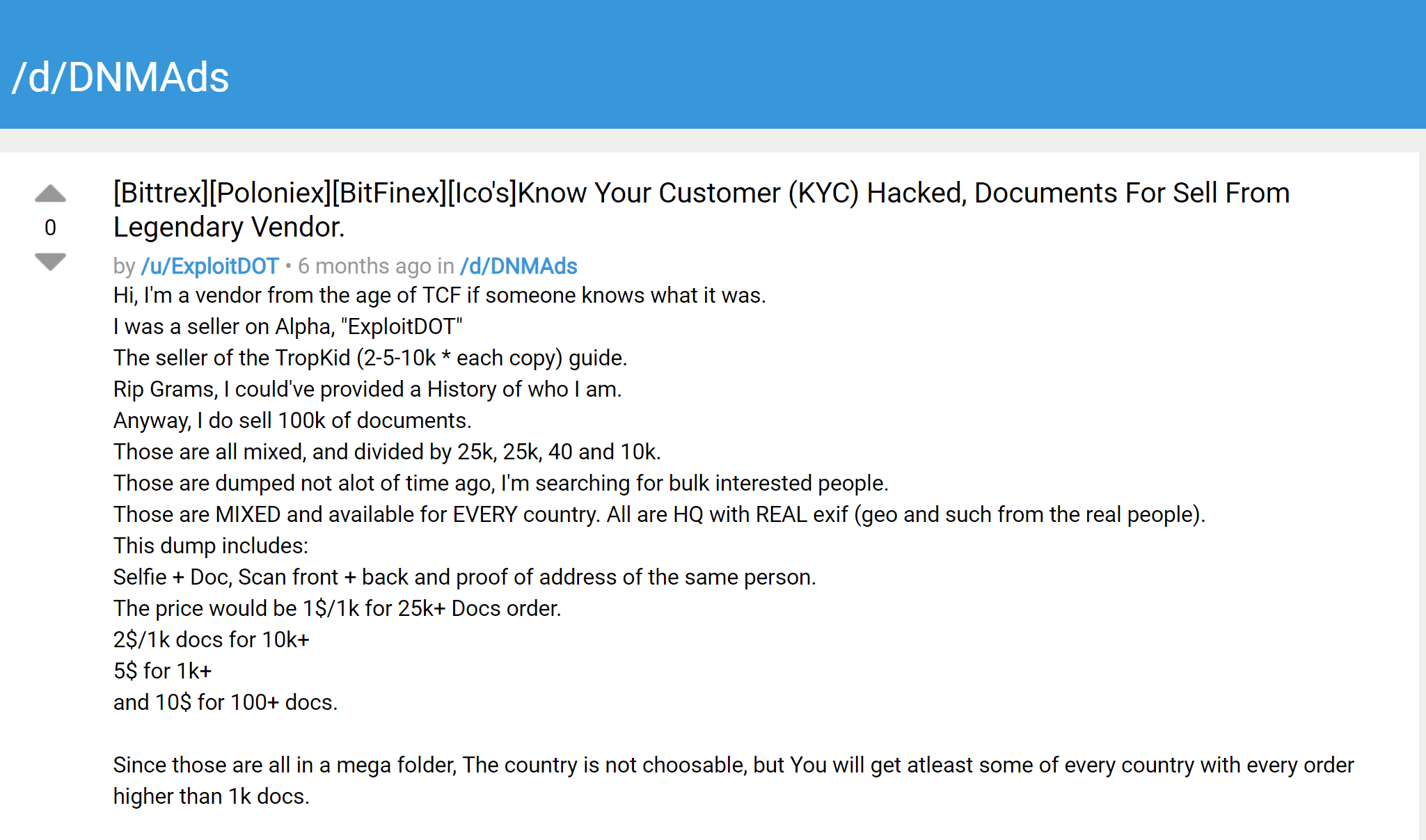

This chapter, although its title might suggest it, is not about not respecting the laws and rules of society, it is again a purely technical matter. KYC, as you will learn, is a horribly designed system full of bugs, which can very easily be a matter of life and death in extreme situations.

“Imagine a website, or rather a darkmarket e-shop, where you can choose any complete identity of any person, including a copy of ID card, passport, proof of current residence address (energy invoice, phone package) and a photo of the face, while holding these documents. Imagine that this identity package is yours and anyone on the other side of the planet can buy it for a few bucks and use it at will. And in a few minutes or hours, he can start washing millions and successfully disguise himself with your identity. "

With quote from Lupták's article: HOW KYC / AML POSES A SERIOUS THREAT TO YOUR PRIVACY AND SHOULD NOT BE USED AT ALL we also get to problems that the vast majority of people are not aware of. And if they were aware of them, probably despite the best referral program, they do not recommend this method of buying and selling bitcoin and other cryptocurrencies to others. Every centralized exchange must have a seat somewhere. Therefore, it also moves within the local legislation and must comply with local laws and regulations. The only difference is in which destination the exchange operators choose. And that is why, with a few exceptions, most stock exchanges are located in offshore destinations, where they are temporarily relatively safe.

In most cases that affect end users, these are the so-called KYC and AML directives. It is used to identify the customer and control money laundering from criminal activities that are outlawed. However, there is nothing wrong with following the rules of the game, in which you voluntarily participated by registering and agreeing to the terms and conditions, as long as no one forced you to do so under the threat of violence and deprivation of your personal liberty or property. But do you know what you really signed up for?

The problem for end users is, by its nature, a poorly designed data storage system that is used to store your aforementioned data. It can be obtained with sufficient motivation and resources and then combined with detailed transaction data, including photographs, which are not cleaned by exchanges from metadata. This can playfully lead to real geo-painting to your door. From the many cases where darkmarkets display sensitive purchase data, such as login details for stock exchanges and exchange offices of individual users together with ID cards, passports, face photos and other sensitive materials, it is clear that these systems, which must be used by centralized third parties, pose the greatest risk to end users.

Before you register somewhere and voluntarily send your complete identity to an unknown place, think about how real danger can be posed by someone who knows what amounts you have at your disposal and where you stop for afternoon coffee. And anyone who watches crime movies, TV shows and reads books a little, despite the screenwriters' wild imagination, has a good idea that it is not the hardest feat to commit any crime motivated by money, but the real challenge is to launder fiat money. Cryptocurrencies are not capitalized enough to run all or part of the black market. But if you can happily wash and legalize the proceeds of crime on behalf of someone else, you are taken care of.

KYC is dangerous.

— Matt Odell (@matt_odell) May 19, 2020

Flagging users who practice privacy best practices such as coinjoin usage is dangerous.

Custodial privacy is dangerous.

Malicious actors knowing your mailing address, email address, and bitcoin addresses is dangerous.https://t.co/DOx5ilC6nD

Of course, the list of negative tradeoffs does not start here and does not end at all. It is worth mentioning one of the more serious issues, which is beginning to appear recently. Exchanges begin to "punish" their customers if they find in your transaction history an attempt to improve the privacy of your bitcoins using CoinJoin. Although not a criminal activity in itself, third parties reserve the right to withhold such bitcoins with an appropriate history and close their clients' accounts. CoinJoin and other privacy enhancement methods provided by the Samourai Wallet mobile wallet ecosystem, for example, do not exist mainly because the bitcoin owner has something to hide, but because he has a choice of what he wants to show to the sender or next recipient. In essence, it is only a human right to privacy, which, for obvious reasons, clearly bothers some entities directly and indirectly affected by the transaction.

Still wondering what Bisq is? The dense piece of text you have just read answers this and the question of why we should use it. The above-described and mere part of the problems posed by the use of centralized exchanges is what Bisq is not. Bisq is a piece of software that solves these problems by design. It addresses the need for trust, the need to authorize or accept a bitcoin transaction, responds elegantly to the issue of privacy, and most importantly omits the need for a third party, thereby mitigating a huge range of dangerous risks that pose serious problems that can result in irreversible and irreparable damage.

Conclusion - let's do things right, it's worth it

Of course, Bisq also has its disadvantages. The biggest ones are low liquidity, and therefore a smaller number of offers than on traditional centralized exchanges. Traders and speculators, who need quick-to-do trades for their craft and who do not care about the main advantages that Bisq brings, will definitely not get their money's worth.

But the core of the matter lies elsewhere. Bisq is not owned by any firm or company and therefore has no legislative framework under which to fall. Thus, it is not possible for states and regulators to grab someone's hand and, according to the law, require information and data about their clients, as is the case with normal exchanges. Bisq has no clients, it only has users using millions of lines of cleverly designed open-source code. There is no intermediary or main server, everything is realized only between the buyer and the seller.

Bisq is a robust, decentralized protocol that can avoid a large 6102 command in the bitcoin edition by a large arc. No one will be able to access your data here unless they know your password and have access to your PC. No one will seize and be able to misuse your stolen documents and sensitive information that you would normally have to provide to a centralized exchange and it could not protect them from hackers.

It's up to you to judge what is worth it and what is not. But know that if you don't need financial privacy today, it doesn't mean you won't need it in the future. None of us knows what situation he may find himself in in the future, and remember that one bad result of an election or vote is enough to make it very bad.

The purpose of this article is not just to guide you how to use an application. It should also evoke the right, somewhat black conscience in all that even a single novice can look up to. Take a breath twice and think about the consequences that your advice and information can bring them and in what situations they can get them. Many errors are irreversible and lead to unrecoverable problems. Referral programs are certainly a beautiful thing, especially if they are not used by one person, but by hundreds, thousands, tens of thousands or more. Try to really think about why and for what reasons Bitcoin was invented, and you may find that recommending centralized exchanges is the equivalent of heading for a path that ends with a fall from a high cliff.

The Bisq Decentralized Peer-to-Peer Exchange is one, if not the best, way to sell and buy bitcoin or other cryptocurrencies such as monero. Its design does not expose its users to dangerous risks, as is the case with traditional centralized exchanges and exchange offices operated by third parties.

Michal Mikle

I'm an overclocker and enthusiast Bitcoiner. With computer hardware, any unused performance won't keep me calm. If there is the possibility of squeezing another drop of power from the hardware, I won't miss it. I love the adrenaline and pushing the limits, of the components and myself. This activity is rich with choices, but I mainly use liquid nitrogen and phase-change methods. I also set up a service to optimise Intel processors, delid.cz, building custom PC setups on demand and I enjoy security and privacy topics. Outside the digital world I'm interested in permaculture and other low time preference systems.