What is Bitcoin Mining and Is It An Environmental Disaster?

Bitcoin has been around for more than 10 years now, but there’s still a lot of confusion and misinformation about it, particularly when it comes to mining. It’s common to see mining described as a way to earn “passive income”, or as an environmental disaster due to its huge energy consumption. Neither description is very accurate. In this article, we’ll take a no-nonsense approach to explain Bitcoin mining and bust the common myth about it being an environmental disaster.

What is Bitcoin Mining and Is It An Environmental Disaster – ARTICLE CONTENT

- What is Bitcoin Mining

- The Mining Process

- Predictable Coin Issuance Because of the Difficulty Mechanism

- The Evolution of Mining Over the Years

- Bitcoin Mining Energy Consumption

- Bitcoin Mining is Necessary

- Bitcoin’s Energy Consumption

- The Takeaway

What is Bitcoin Mining

In a nutshell, mining is how people get paid to process Bitcoin transactions. A miner can be anyone with a dedicated machine (ASIC) for mining Bitcoin, access to electricity and internet. Simply plug the machine into a power supply, connect to the bitcoin protocol through a pool, and let it run. You are now processing transactions on the Bitcoin network.

Jan Capek (@janbraiins) of @braiins_systems and @slush_pool discusses the lack of open-source code in the bitcoin ecosystem.

— Bitcoin 2021 (@TheBitcoinConf) June 26, 2019

“We don’t have transparency and auditability for mining hardware out there today.” pic.twitter.com/Dna197JK8o

Despite being simple to set up, it's costly. Each new mining machine will cost several thousands of dollars and consume a large amount of electricity. Retail mining is still possible but uncommon because of the costs associated, and most retail miners buy used hardware because the new-generation ASICs aren’t affordable. This has led mining to be predominantly performed by large organizations that can deploy thousands of miners in one facility, benefiting from economies of scale. In order for retail and small scale mining to have a resurgence, BTC price growth will need to outpace difficulty growth significantly. (Luckily, this is typically what happens during bull markets.)

Bull markets: price growth outpaces hashrate/difficulty growth because there's a shortage of mining hardware.

— Slush Pool | Braiins (OS+) (@slush_pool) August 26, 2020

Bear markets: hashrate/difficulty have time to catch up as new batches of hardware ship, shrinking the gap between cost of production and market price.#MiningInsights https://t.co/aVoSuIL4vs

i

Bull markets: price growth outpaces hashrate/difficulty growth because there's a shortage of mining hardware. Bear markets: hashrate/difficulty have time to catch up as new batches of hardware ship, shrinking the gap between cost of production and market price.

Bear markets: Early on in bear markets, the average cost of production for miners is still far below the market price of BTC. As a result, the network hashrate / difficulty continues to increase as new batches of ASICs are received, meaning that the cost to mine 1 BTC increases even as market price decreases, until the two values reach equilibrium again.

The Mining Process

Miners group people's transactions and verify them in what's known as a “block” of data. These blocks usually contain several thousand transactions, each of which has a transaction fee which pays the miner who includes it in their block. Existing blocks are full of bitcoin transactions that occurred in the past and are permanent (or rather, so costly to change that everybody can be reasonably certain that they will never change).

This process of grouping, verifying, and adding blocks occurs approximately every 10 minutes. Each time a new block is found and validated by nodes, the whole process is repeated again, and miners compete to find the next block to get added to the existing blocks. This string of blocks is referred to as the blockchain. Thus, miners compete to have their block added to the blockchain.

Predictable Coin Issuance Because of the Difficulty Mechanism

In order to propose a new block and earn the block subsidy and transaction fees in it, miners compete to solve a puzzle. This process, called proof of work, involves plugging trillions of random data strings into a hash function each second and checking the value of the output versus the difficulty target. (This is why hashrate for miners is typically measured in terahash/second.) If the output value from one of these random inputs is below the network difficulty target, the miner gets to propose their block to the rest of the network.

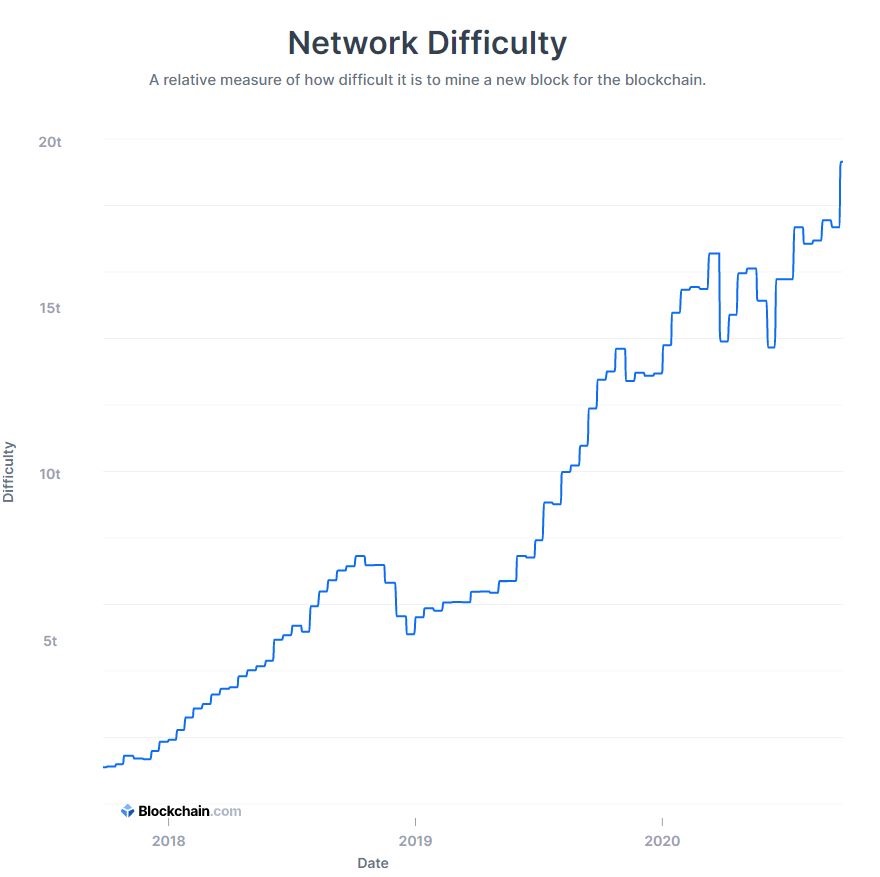

After a puzzle gets solved, a new puzzle is created and miners almost immediately start competing to solve the new one. You might be wondering what happens when more miners join? Wouldn't finding a solution become easier and therefore faster since more miners are working on the same puzzle at once? The answer is yes, but the Bitcoin system has a feature where the difficulty of solving the problem is adjusted so that on average the problem is solved every 10 minutes.

If more people start mining, the puzzle will adjust to be harder to solve. If people stop mining, the puzzle will adjust to be easier to solve. No matter how many miners join or leave the competition, the average time to solve a puzzle will remain 10 minutes. This adjustment occurs every 2016 blocks that get added to the chain, or approximately every 2 weeks.

In summary, the Bitcoin network difficulty is what ensures that bitcoins are steadily released into circulation according to a transparent issuance schedule. This predictable, fixed supply is one of the unique features of Bitcoin.

The beauty of Bitcoin is that its adoption is both permissionless and entirely voluntary. It's the virus that people choose to catch.

— Slush Pool | Braiins (OS+) (@slush_pool) December 5, 2019

Cool paper by @nsquaredcrypto: https://t.co/t8MNogcTBF pic.twitter.com/SDXY21dU3O

The Evolution of Mining Over the Years

As more miners joined the network and the puzzle became harder to solve, miners decided to combine their hash power in an effort to earn more consistent rewards. This led to mining pools. Miners would connect to a pool and be part of a team to facilitate the combined hash power of miners. The world’s first mining pool is Slush Pool, which launched in 2010 and is still running today.

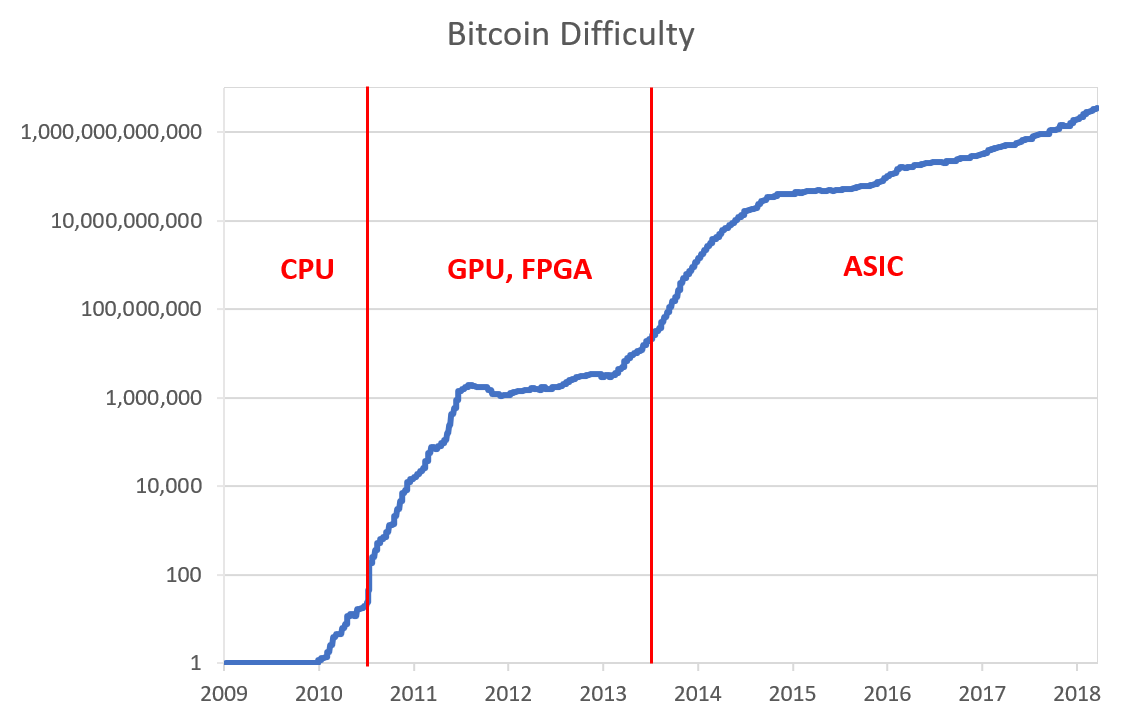

At that time, mining was mostly being done on CPUs and GPUs. Within a couple of years, specialized hardware was developed specifically for mining Bitcoin. By 2014 most of Bitcoin’s hashrate came from this specific hardware, called ASICs.

With the maturation of the mining industry and the continued trend of increasing competition, miners also began using custom software and firmware to make their mining rigs run more efficiently. This became a particularly big deal in 2017-2018 when firmware was first used to save miners about 13% on their energy bills by enabling AsicBoost.

Somewhere around 2017 we came with the idea of free open source firmware called Braiins OS ;-) to make mining more robust and transparent #bOS @slush_pool @braiins_systems https://t.co/xcMe6CAgdE

— Jan Čapek (@janbraiins) November 8, 2019

Today, AsicBoost is an industry standard and the most popular firmwares are also performing a process to improve performance called autotuning, which optimizes the efficiency of miners by calibrating the frequencies and voltages on every chip in the hardware. The best known autotuning firmware on the market today is Braiins OS+, which is also developed by the Slush Pool team.

In China, most miners use stock firmware provided by their hardware manufacturer. Outside of China, however, custom firmware is becoming more and more popular every day.

— Slush Pool | Braiins (OS+) (@slush_pool) July 20, 2020

As @WillHash4Coins explained on @H4SHR8, Braiins OS+ is built for the professionalized mining industry. pic.twitter.com/GNapAcMwg5

Bitcoin Mining Energy Consumption

Since every miner in the network is performing trillions of computations per second, the energy consumed by these miners is substantial. Energy consumption is an intentional and necessary component of proof of work, which is how Bitcoin achieves its decentralized consensus.

However, this leads us to a common talking point about Bitcoin…

“Bitcoin mining is an environmental disaster.”

Many articles on the internet and social media commentators make claims like the one above. Bitcoin mining is energy intensive. But should we be concerned that its energy consumption and carbon emissions pose a real threat to society?

We compiled a collection of studies and arguments made over the years as to why Bitcoin mining is not an environmental disaster and how it tends to be misunderstood in the mainstream. Our goal is to distill these arguments and present them in a cohesive way.

Bitcoin Mining is Necessary

Miners compete with each other to have their block of transactions added to the existing blocks (ie. the blockchain). The first one to do so, earns a reward. They compete through hash computations. The more hashes produced, the greater the probability of winning the reward. By converting electricity into hashes they prove to the network that they have paid a cost to participate which anybody can verify.

i

“This system is the most simplistic and fair way for the physical world to validate something in the digital world”

“Proof of Work (PoW) transmutes electricity into digital gold.”

Dan Held in Proof of Work is Efficient

Does this give Bitcoin a legitimate claim on society’s resources?

Bitcoin power usage seems less extreme when compared to power usage of video game consoles or Christmas lights. However, it appears significant when it consumes as much electricity as small countries. Perspective matters here. But the fact is people are paying to have their transactions included in the blockchain. Something voluntarily exchanged cannot by definition be a waste.

People find Bitcoin useful and that’s why they are subsidizing miners. For an individual to say that this is a poor use of society’s resources because they don’t find Bitcoin valuable is akin to them complaining that other people shouldn’t be able to buy video game consoles and consume electricity to power them because they don’t like video games.

Bitcoin’s Energy Consumption

One important factor to consider is that Bitcoin mining can take place anywhere in the world. Unlike traditional mining operations (e.g. for gold or diamonds), Bitcoin mining is highly distributed geographically and moves to wherever power is cheap.

Claims are often made that because Bitcoin mining is energy intensive, it becomes a drain in areas where it occurs. This is inaccurate.

Firstly, Bitcoin mining operations are most commonly located in areas where there is an oversupply of electricity. Why? Because these are the areas where electricity is cheapest — supply is greater than demand and existing technology is not sufficient to effectively store and transport supply to population centers where demand is higher. This is important for mining operations because electricity costs can account for up to 70% of their total costs of operation.

For us, there are two in BTC mining:

— Slush Pool | Braiins (OS+) (@slush_pool) September 27, 2019

1) Lack of open-source software

2) Centralization of HW manufacturers & pools

We're working on improving both 💪https://t.co/8ejcBlkVFh

The province of Sichuan alone produces ~54% of global hashrate. This is largely due to an overbuild of hydroelectric power in the provinces of Sichuan and Xinjiang. The installed hydro capacity is double what its power grid can support, leading to an enormous quantity of surplus electricity.

i

“Part of the reason Bitcoin consumes so much electricity is because China lowered the clearing price of energy by overbuilding hydro capacity due to sloppy central planning. In a non-Bitcoin world, this excess energy would either have been used to smelt aluminum or would simply have been wasted.”

Nic Carter summarizes in his article on Bitcoin’s energy consumption,

Hydropower is effective for Bitcoin mining as the marginal cost of generation is essentially zero and it is a stable source of production. A study performed by the BitMEX research group revealed that the majority of Chinese Bitcoin mining operations are in areas of relative oversupply from hydropower operations.

In summary, Bitcoin mining typically consumes electricity which would never reach an energy grid in a large population center. Any honest comparison of energy consumption between Bitcoin mining and other sources like heating and air conditioning or video game playing should account for this fact.

And to be clear, these mechanics incentivizing mining to occur in locations of overproduction (a majority of which is renewable energy) are applicable to Bitcoin mining outside of China, as well. On a global scale, it’s estimated that some 74% of all Bitcoin mining electricity comes from renewable energy sources.

The Takeaway

Bitcoin’s energy consumption often gets singled out because it’s easy to quantify. Yes, Bitcoin mining is energy intensive. However, this is a necessary component of Bitcoin’s value proposition: borderless, scarce, digital, censorship resistant cash that you can use without trusting a 3rd party.

What areas of the Bitcoin ecosystem are the most concerning for you?

— Slush Pool | Braiins (OS+) (@slush_pool) September 27, 2019

What's being done to move them in the right direction?

If you don’t recognize the value of Bitcoin and Bitcoin mining, perhaps it’s because you haven’t experienced slow and expensive cross-border transactions, hyperinflation, or financial censorship and disclusion.

Finally, let’s acknowledge a simple fact. If Bitcoin became worthless, all mining would stop. To put it bluntly: if you still believe that mining is highly problematic for the world, your best option is to work on improving the existing financial system to be more inclusive, more efficient, and more trustworthy so that it can outcompete Bitcoin and thus weaken the incentive for miners to operate.

Daniel Frumkin

Daniel Frumkin creates technical dokumentacion and is a part of business development in Braiins (Slush Pool & Braiins OS). He is also author of book about blockchain technology. Nowadays he works on technical specification of Stratum V2 protocol. Twitter: @dfrumps