Bitcoin: Everything You Want to Know

Bitcoin has been with us for over eleven years. Yet it is still misunderstood by most people. Many see it as an ephemeral or perhaps even fraudulent project. However, the wider adoption of bitcoin may soon represent one of the most fundamental changes in our lives. Why and how bitcoin was created, how it is mined, how and where to buy it, how to hold it safely and where to pay with it? Our article answers these and many other questions.

What Can You Learn About Bitcoin in This Article?

- Why Bitcoin Exists: a Separation of Money and State

- What is Bitcoin?

- Bitcoin as a Deflationary Currency

- Bitcoin and Monetary Economics

- Bitcoin Mining

- How Does a Bitcoin Wallet Work?

- The Course of a Bitcoin Transaction

- What Does Bitcoin Solve on a Technical Level?

- How to Get and How to Buy Bitcoin?

- How and Where to Pay with Bitcoin?

- What Is the Current Bitcoin Exchange Rate?

Why Bitcoin Exists: a Separation of Money and State

Bitcoin has a more far-reaching effect on us than most people realize. Bitcoin in its entirety is hard to understand in one go. A fitting comparison of Bitcoin is to the living organism. It develops, adapts, reproduces, and defends. Some even describe it as a virus or a Trojan horse that seeks and corrects what is wrong with our world.

Many people see bitcoin as a means of payment - a better PayPal. Such people are then perplexed as to why Bitcoin isn’t used for payments that much. Bitcoiners rather consistently choose to “hodl”: hold bitcoin for the long term. The truth is that bitcoin is much closer to full-fledged money than to a mere payment instrument. And because fiat money has almost completely lost its role as a store of value, it is Bitcoin that brings back that function to the world.

In addition to restoring the savings function, bitcoin has the potential to fundamentally transform the global economy. In the last fifty years, the global economy and society have been badly affected by the pure fiat money standard. Fiat money has no link to gold or any other anchor that would tame the state's monetary policy. Paper money has devastating consequences: strong economic cycles, enrichment of the financial sector at the expense of other sectors, shortening decision-making horizons, heavy indebtedness of the state, the companies, and the households. If we want to live in a truly prosperous society, we need a market order - which also requires market money. And the only real market money today is Bitcoin.

Bitcoin represents a unique combination of features: decentralization, the long-term sustainable motivation of miners, a predictable and unchangeable monetary policy. The history of mankind is marked by the constant abuse of the monetary monopoly by the rulers and the state; in the case of Bitcoin, no one holds such a monopoly. Every Bitcoin node operator is a sovereign.

Bitcoin is simply nothing less than the separation of money from the state. Today's financial world is defined by pure monetary socialism: the entire financial system is controlled by the central bank, it operates on special privileges, and privileged institutions are bailed out when there are problems at the expense of other sectors of the economy. Bitcoin is a solution to this problem.

What Is Bitcoin?

Bitcoin is the first and most widely used cryptocurrency. It was launched on January 3rd, 2009 by a programmer (or group of programmers) known under the pseudonym of Satoshi Nakamoto. Bitcoin allows you to make payments to anyone in the world - no bank account or registration is required; you only need to download one of the many bitcoin wallets. Global payments are made possible with the help of peer-to-peer technology, which works without any central administrator. Transaction processing and issuance (also known as mining) are carried out collectively. The right to write new transactions is won on average every ten minutes by someone who provides adequate proof of sufficient computer power (called proof of work). Confirmed transactions are ordered in blocks and recorded in a decentralized, append-only database called the blockchain.

i

Peer-to-Peer

A computer network in which software clients communicate directly at an equal level, without the need for an intermediary. In the case of bitcoin, the most popular software client is Bitcoin Core.

Bitcoin creator Satoshi Nakamoto did not come up with bitcoin just by a stroke of genius. In the Bitcoin whitepaper, Satoshi refers to earlier projects on whose technological knowledge he built. These were mainly projects from a group of so-called cypherpunks - hacker activists who seek to strengthen freedom with the help of technologies that improve privacy in the digital environment. Satoshi specifically mentions the Hashcash and b-money projects. Bitcoin is an elegant combination of several previously known technologies. These are in particular:

- Cryptographic hash: a hash is the result of a mathematical function that creates a fixed-length string from a text or number of any length. A hash function is a one-way mathematical function, i.e. hash is easy to calculate from a text or number, but it is impossible to derive the original text or number from the hash (other than by testing all the possibilities). Hash is also very easy to verify. Try it for yourself: the word

bitcoinalways results in a hash6b88c087247aa2f07ee1c5956b8e1a9f4c7f892a70e324f1bb3d161e05ca107b. Here we used the SHA-256 hash function used by bitcoin. - Proof of work: Miners must provide proof of performed work to qualify for the right to append a new block to the blockchain. They provide the proof in the form of a hash, which meets the requirement defined by the Bitcoin protocol. The requirement is that the hash has to be below a certain threshold, i.e. that it has a certain number of leading zeros. The more zeros, the harder it is to find such a hash. This ensures that blockchain transactions are written only by those who have expended enough energy (to discourage the motivation to cheat) and that bitcoin blocks are created on average every ten minutes (for the predictable emission of new bitcoins into circulation).

- Hash chaining: individual bitcoin blocks are linked together by referring to the hash of the previous block. The whole blockchain is thus a chain of consecutive blocks, from the first Genesis block up to the present day.

- Cryptographic key pairs: the basic identifier within bitcoin is the so-called private key. It is an alphanumeric string generated by a cryptographic function. It is possible to generate public keys from the private key. A bitcoin address for receiving payments is then generated from the public key. Only the corresponding private key can spend bitcoins on the address generated in this way. Bitcoin uses the ECDSA algorithm to generate private keys.

Bitcoin has been operating for over ten years without a single downtime. During this time, there have been many technological improvements, exchange hacks, wallet hacks, attempts at regulation, or outright banning. However, bitcoin is still running, reaching out to more and more programmers, economists, investors, and ordinary people looking for a means of preserving purchasing power that cannot be easily confiscated and debased.

Bitcoin as a deflationary currency

The total number of bitcoins will never exceed 21 million. This is not just a promise from developers, but a limit that is built directly into the bitcoin protocol - a set of rules that define what bitcoin is. Compliance with the protocol is supervised by a decentralized network of nodes. Tens of thousands of Bitcoin nodes are running all over the world.

i

What is a bitcoin node?

Wondering how and why to run your own bitcoin node? Read in our article What is a Bitcoin full node? (BITCOIN BASICS).

Although the total number of bitcoins will never exceed 21 million, the number of bitcoins in circulation will likely decline over time. We already know that about 3.8 million bitcoins have not moved for more than 5 years. These are probably bitcoins for which the owners have lost their private keys. This number is likely to grow due to errors in handling the private keys. Bitcoin thus represents a deflationary currency - a currency in which the number of units in circulation decreases over time.

In practice, the above means that as the value of bitcoins is likely to increase, the amount of coins needed to purchase goods will decrease. The average transaction size will decrease and increasingly, we will think in satoshi instead of whole bitcoins. Some bitcoin projects - for example, the Lightning Network payment superstructure - already take this into account and list all values in satoshi units.

i

Bitcoin and satoshi

The lowest denomination of bitcoin is named after Bitcoin's creator, Satoshi Nakamoto. One bitcoin is divisible into 100 million satoshis. Satoshi is also often abbreviated as "sat".

1 BTC = 100,000,000 sat

1 sat = 0.00000001 BTC

Bitcoin's independence from any authority is a fundamental pillar of its credibility. The bitcoin community works with the motto "don't trust, verify" - all source code, as well as various software implementations and infrastructure (e.g. wallets), are open and transparent. This way, everyone can verify that bitcoin truly works as others claim - and that, for example, no further units above the 21 million limit will ever be released into circulation.

Bitcoin and Monetary Economics

"Fiat lux", or "let there be light" - according to the book of Genesis, the first words spoken by God. The Creator created light here from emptiness. Today's national currencies with a forced circulation are often called "fiat money" precisely because their value and very existence stems from order; not of God, but a central bank official.

The declared goal of central banks worldwide is price stability. Price stability is usually defined as low and predictable year-on-year growth in the Consumer price index (CPI). Typically, the target for year-on-year CPI growth - the so-called inflation target - is around 2%. In the event of inflationary pressures (prices rise faster than the inflation target), the central bank will try to reduce the money supply through a restrictive policy (for example, by raising interest rates). If the pressure is deflationary (decreasing prices), the monetary policy is then "loosened" and the money supply is increased. Central bankers thus seem to hold the reins of national currencies firmly in their hands and, with the help of their mathematical models and statistical surveys, know exactly how to lead the nation to a bright future of stability and prosperity. In reality, however, central planning in the field of money inflates both consumer prices and speculative bubbles. Newly created money does not spread evenly throughout the economy. Fiat money thus does not have a neutral effect on the economy; the non-neutrality of money is called the Cantillon effect.

The Cantillon effect: "the first ones to receive the newly created money see their incomes rise, whereas the last ones to receive the newly created money see their purchasing power decline as consumer price inflation comes about." https://t.co/glvGFWiRZjhttps://t.co/TUPlIlo78a

— Nick Szabo 🔑 (@NickSzabo4) August 19, 2018

Nick Szabo on the Cantillon effect.

Cryptocurrencies, led by bitcoin, operate on completely different principles. In particular, there is a lack of a central authority capable of influencing the money supply. Satoshi Nakamoto designed bitcoin to make the pace of releasing new units into circulation completely transparent and predictable over the long term. The bitcoin protocol determines how many new bitcoins come into circulation with each mined block. Miners and all other bitcoin users must follow this protocol if they want to stay part of the network. The issuance rate and the final amount of bitcoins are therefore known in advance and no one can do anything about it. Moreover, new bitcoins are released on a fair basis - through the effort expelled to find the valid hash.

i

Satoshi Nakamoto's take on fiat currencies

The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.

-Satoshi Nakamoto at P2P foundation, 2009.

What does this mean in practice? Bitcoin doesn’t have a centrally controlled supply, so its price, contrary to fiat currencies, is indeed market-based. Supply is predetermined and unchangeable, so the price is mainly influenced by demand. Short-term demand goes through cycles called FOMO (fear of missing out) and FUD (fear, uncertainty, doubt). The long-term price trend is positive, which is in line with the fact that people around the world are just discovering the value of bitcoin properties, such as uncensorable transactions and global accessibility. Due to the fixed supply and no single point of failure, bitcoin is increasingly viewed as a long-term store of value.

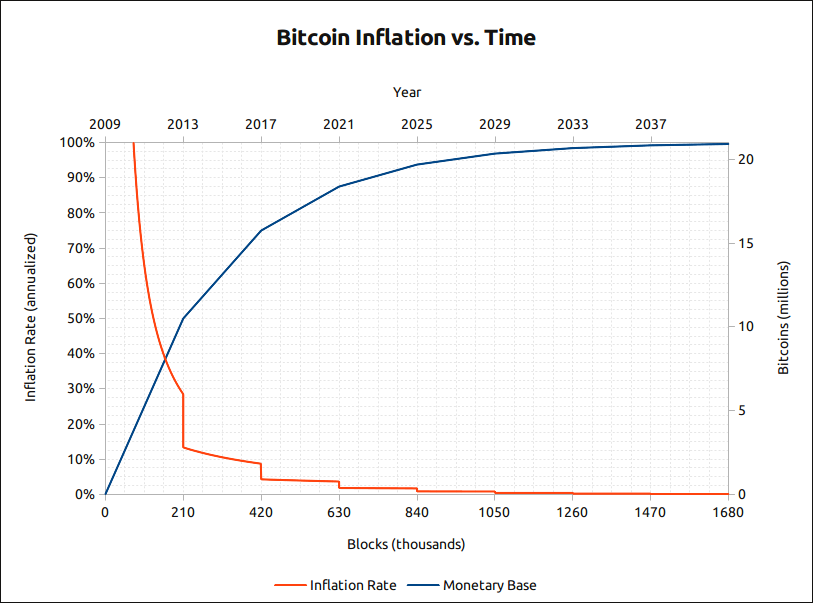

Bitcoin protocol sets the emission rate. Every 4 years, the amount of newly mined bitcoin is cut in half.

Market capitalization and exchange volume also play a role. The market capitalization (i.e. the number of units in circulation multiplied by the current unit price) was around 200 billion USD in October 2020. By comparison, the total market capitalization of gold is about 9 trillion. Market capitalization correlates with price volatility - the higher the market capitalization of bitcoin, the lower price fluctuation is observed. Bitcoin price volatility is already very low compared to the initial years - during 2011 the price of bitcoin rose from 0.3 USD to 30 USD in a few months, then the price fell to 2 dollars. Bitcoin no longer experiences such wild swings precisely because of the high market capitalization, which requires an ever-increasing amount of money for the same relative movement in price.

Nevertheless, bitcoin is still very volatile compared to traditional financial markets. Moreover, it’s being traded non-stop, 24/7. The volatility and non-stop trading provide for a very stressful environment if you day trade. In the long run, the safest strategy seems to be the so-called "hodl" - long-term holding of bitcoin without worrying about short-term price fluctuations. In any case, you should be familiar with all the essentials of holding private keys - and, of course, you should not put into bitcoin more than you can afford to lose.

Bitcoin Mining

Bitcoins are generated through the process of mining. Mining can be described as a "mathematical lottery" - the right to include transactions in a block and append this block to blockchain is won by the person who provides sufficient proof of work. The proof is given in the form of a hash starting with a certain number of zeros. As mentioned above, such a hash is difficult to find but easy to verify. Why are miners required to expend high computing power, which naturally means consuming a large amount of energy? So that the system can operate without a central administrator, and at the same time, its participants are deterred from fraud. Thus, only those who "buy" this right can record transactions, and the price for this right changes dynamically so that it is always more advantageous to accept a reward for a mined block than to try to deceive others.

The reward for mining is twofold: the miner receives the newly created bitcoins, as well as the transaction fees from the transactions he has included in the block (and thus confirmed them as completed). Newly created bitcoins are still the main component of the mining reward - more than 90% of the current mining reward comes from newly created bitcoins. Initially, miners received 50 bitcoins every 10 minutes. This block subsidy is halved every 4 years. Between 2009-2012, 50 bitcoins were put into circulation every 10 minutes, in 2012-2016 it was 25 bitcoins, in 2016-2020 it was 12.5 bitcoin. In May 2020, the bitcoin network underwent another halving and the block subsidy is currently 6.125 bitcoin.

In the first years, miners are thus motivated mainly by newly issued bitcoins, but over time transaction fees have to gain dominance. We can assume that around 2030, the security of the system will depend primarily on transaction fees, not on newly issued bitcoins. It is therefore a mistake to call bitcoin a system with low transaction fees - these will rather grow over time, and with them also the settlement value of individual transactions.

i

Are you interested in mining bitcoin in more detail and from a practical point of view? Read our special How does bitcoin mining work and how to mine profitably? (GUIDE)

How Does a Bitcoin Wallet Work?

Before we get to the technical details of bitcoin transactions, it is necessary to get acquainted with the key element for the interaction with bitcoin - the bitcoin wallet. The wallet allows you to receive, store, and pay with bitcoin.

i

Recommended: Samourai wallet

User and transactional privacy is an oft-neglected feature of bitcoin wallets. We recommend getting familiar with the Samourai wallet, where the privacy is the priority. Samourai Wallet – Bitcoin wallet with privacy on steroids.

A bitcoin wallet is a software that manages user's private keys. The wallet can be operated on a mobile phone, laptop, or using a specialized device called a hardware wallet. The user has his private keys stored in the wallet. Private keys are used to sign bitcoin transactions. The user should always keep the private keys under his exclusive control.

i

A private key in the context of bitcoin is a secret string that allows you to spend bitcoins. Each wallet contains one or more such keys, which are stored in a wallet file.

Public keys are generated from private keys, from which the addresses are further generated. To back up the wallet in case of loss or damage to the device, only private keys are needed - typically stored in the form of a seed, which is a human-readable series of simple English words (typically 12 or 24 words).

Specialized programs called wallets are used to manage private keys. The most secure type of wallet is the hardware wallet, from which the private key cannot be read in any way (the transaction is signed with the private key directly in the device and the private key is not legible from the outside).

The public bitcoin address is indirectly generated from the private key and is a string of numbers and letters; the address can be compared to a bank account number. The private key entitles you to spend bitcoins on addresses that were generated from the private key. You can let others know your bitcoin address, but keep in mind that in such a case, anyone who has seen the address can look up your balance (although no-one can spend from the address because they don't have the corresponding private key).

The Course of a Bitcoin Transaction

Bitcoin allows anyone in the world to send funds with e-mail-like simplicity. It doesn't matter where in the world a person is, how old he is, what his religion or nationality is, or whether it is a night, a weekend, or a holiday. The only thing that matters is whether the user has an internet connection and holds any bitcoin in his wallet.

The first important piece of information is that bitcoins do not exist per se; there are only records of the past transactions and the addresses’ balances. So if you want to send bitcoins, you only need two things from the technical point of view - the recipient's public bitcoin address and your private key.

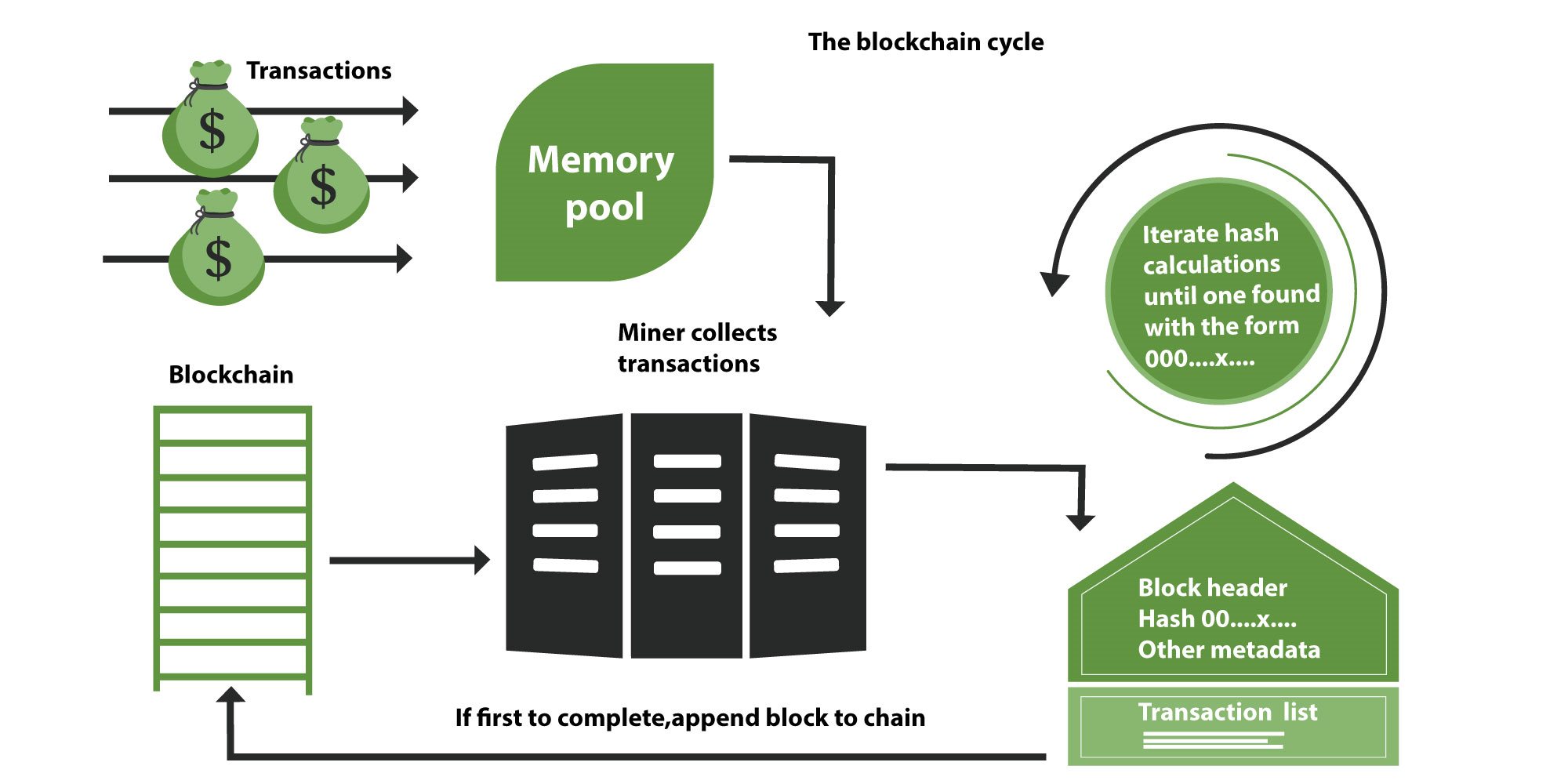

To conduct payment in a typical bitcoin wallet, the user enters the sending amount (in bitcoin or national currency) and the recipient's address. The wallet then compiles a bitcoin transaction, signs it with the private key, and sends the signed transaction to other bitcoin nodes. The signed transaction does not contain a private key - only its "fingerprint" in the form of a cryptographic signature, which is valid only within one specific transaction (i.e. this signature cannot be misused to steal bitcoins). Everyone on the bitcoin network knows about all existing transactions. Each valid (properly signed) transaction is spread through a network of distributed nodes, some of which are so-called mining nodes - these conduct the final confirmation of the transaction in the form of its inclusion in the block and appending of this block to the blockchain.

A fee is charged for a confirmed transaction, and the fee size is determined in advance by the user. The average fee size undergoes considerable fluctuations - sometimes transactions with minimum fees (in the order of cents) get confirmed within minutes, other times the demand for fast confirmation of transactions is higher and the average fees reach the order of dollars. Transaction fees will increase in the future (as the block subsidy gradually decreases), so all bitcoin users should learn how to work with transaction fees. The most important thing to learn is to estimate the confirmation time and the required fee. The best tools for that are Mempool Space and BitcoinFees.

However, the above does not mean that bitcoin transactions always have to be expensive. For the sustainability of smaller transactions (or even microtransactions) with low or even zero fees, we have a “second layer” solution called Lightning Network.

The bitcoin transaction itself begins by signing a message that contains inputs (the source transaction or even more transactions that gave you the bitcoins you are sending), the quantity (how many bitcoins you are sending), and the outputs (most often the public bitcoin address of the recipient).

The transaction lifecycle: signed transactions are stored in mempool (a database of unconfirmed transactions). When the miner includes the transaction in the new block and finds the valid hash, the transaction is confirmed (appended to blockchain).

The message thus compiled and signed is then sent from your bitcoin wallet to the broad bitcoin network. At this moment, the miners start to play a role. They verify the validity of the transaction, include it in a new block together with other transactions, and then confirm (mine) this whole block and append it to the blockchain. A blockchain is nothing more than a chain of consecutive blocks of transactions.

When you make a bitcoin transaction, you always keep track of the number of so-called "confirmations." The transaction without confirmation is only in the nodes memory, but has not been mined yet. The first confirmation provides information that the transaction was listed and extracted by the miner in the last block. Further confirmations mean that this block is followed by other blocks and the transaction cannot be changed back.

When sending larger amounts, it is advisable to wait for a higher number of confirmations, ideally 6 or more. The reason is that a transaction can be part of the so-called "depleted" block.

What Does Bitcoin Solve on a Technical Level?

Satoshi Nakamoto's main contribution is a solution to the problem of double-spending. Bitcoin was preceded by various distributed databases that could be used as a ledger of who owns what. If someone wants to transfer funds from account to account, they must somehow prove that they are spending funds they rightfully own. For the authorization to work without an intermediary, asymmetric encryption can be used, i.e. signing with a key pair. The account can be identified by the public key, and only the person with a corresponding private key can sign a valid transaction. Everyone else can easily verify that the signature is correct, so the funds are sent by the rightful account owner. Various methods of strong encryption have been known since the 1970s when RSA was invented, so this is nothing new (one minor detail is that bitcoin uses slightly newer cryptography based on elliptic curves).

However, before bitcoin was invented, one problem persisted: if an account owner can sign a transaction that sends money to account A, what prevents him from sending the same funds to account B at the same time? The private key doesn’t disappear after the first signature. How should the network behave in such an attempt at double-spending? An example: a buyer creates a transaction that transfers money from his account A to merchant’s account B. Merchant sees that he has received the funds and hands over the goods (for example, a bullion). Buyer takes their bullion, leaves, and creates another transaction that transfers the same money from account A to the other buyer's account C. Which of those transactions is correct? The first one? The second one? Neither? What if they are both created at the same time and each transaction is sent to a different part of the network? Distributed databases themselves do not have an answer to this, there is no resolution to this conflict. This could mean a financial loss to the merchant.

Bitcoin is a solution to the Byzantine Generals Problem. Its removal of double-spend + tamper-evasive consensus = USD that can't be manipulated

— Daniel Ƀ (@csuwildcat) November 3, 2017

In the physical world, the double-spend problem is easy to solve, as it is not possible (or cheap) to duplicate cash. The merchant is therefore certain that once the buyer hands over a banknote, he cannot spend it on something else. For digital transfers, the intermediary is the bank, which guarantees that if a person sends money from his account, he will not be able to send it again. But for many reasons, we don't want a similar central clearinghouse in bitcoin.

Satoshi Nakamoto solved the double-spend problem with a so-called "blockchain", which is just a database of transactions. The basic idea is that only the transaction that gets into the blockchain is valid. There cannot be two conflicting transactions in the blockchain. In the case of double-spending, the blockchain does not guarantee which of the transactions will be the valid one in the end, but it guarantees that it will always be just one of them and everyone will know which one it is. So if a gold trader sees that there is a transaction in the blockchain leading to his address, he knows he can hand over the gold to the buyer. If the merchant sees that there is a conflicting transaction in the blockchain, he will not give him gold and no trade will take place.

From a technical point of view, a blockchain is a relatively simple data structure. It is literally a chain of blocks, where each subsequent block contains the hash of the previous block. This ensures that a block of depth N can only occur after block N-1 is known (because its hash is not known until then). A block is simply a chunk of data: reference to a previous block, other metadata, and transactions that are hereby confirmed. Block also contains a special transaction in which new bitcoins and fees from the confirmed transactions go to the miner's address. If the block is valid, the miner will receive a reward. If a block contains invalid transactions such as conflicting transactions, greater mining reward than the miner is entitled to, or any other transactions violating the bitcoin protocol, then no peer in the network accepts his block and it is ignored. In the meantime, another miner creates a valid block and receives the reward.

Bitcoin presents a timestamp consensus protocol and double-spend solution in one.

— Attila Aros (@AttilaAros) May 7, 2019

One does not exist without the other. You cannot introduce a pre-existing solution to either.

The system of Bitcoin is simultaneously proposing a solution to both problems at same time.

Going back to the gold dealer example, the buyer has another option on how to cheat the merchant. The buyer can have the transaction confirmed, leave with the gold, and then generate an alternate version of the blockchain that would invalidate his original transaction and confirm a new transaction. This is, of course, undesirable. That is why bitcoin applies the proof of work.

Proof of work is a mechanism where the creation of a block is intentionally complicated and substantial energy must be spent on it. The idea is that for a buyer to be able to falsify his transaction, he would have to mine parallel blocks faster than the rest of the network. Which he can't, because he doesn't have that much hashing power, as that would cost a lot of money. Proof of work assumes that most of the hashing power is held by "honest" miners for whom it isn't profitable to cheat.

Whether or not this assumption is true, in practice such a fraud attempt would be so expensive that the buyer would have to buy a lot of gold to make it worthwhile. And if he bought a lot of gold, the trader could wait for more confirmations, making the fraud economically inefficient. As the number of confirmations required by the trader increases, so does the number of required blocks mined in parallel to commit a fraud; the more confirmations, the more expensive the fraud would be.

!

Cheating in Bitcoin just doesn't pay off. Why?

In addition to the mentioned costs of performing a double-spend, the attacker will automatically lose the reward for the mined block if he fails to pull off the double-spend. The hashing effort is expelled in vain if he receives no reward. If he succeeds in the double-spend, he can be prosecuted, as the main targets of a double-spend attack is always an exchange, which will turn to law enforcement.

The trader can thus wait for enough confirmations to make sure the scam doesn't pay off. For a bar of gold he may want 5 receipts, for a ton of gold he may want 100 receipts, and for a coffee he may leave the payment without a receipt, because it is a small amount ("receipt" is the number of blocks linked to the block with the given transaction, including this block).

How to Get and How to Buy Bitcoin?

Bitcoin can be obtained in three ways. It can be mined, bought, or earned. Mining bitcoin is not easy, so most people have no choice but to buy it for fiat money or get it as remuneration for their work.

Buying Bitcoin?

When it comes to buying bitcoin, there are two fundamentally different options. Bitcoin can be purchased anonymously, i.e. without any verification of personal data (name and surname, address of residence, identity card), or alternately with the identification, or a so-called KYC/AML, which are guidelines that make customer identification mandatory for the service providers.

Of course, the first option is closer to the true nature of Bitcoin as a technology that promotes privacy and financial inclusion.

Buying bitcoin without verification

- Peer to Peer exchanges (Bisq, Hodl Hodl),

- bitcoin ATMs,

- Alza PayBoxes through our iOS/Android app (up to 1000 € in cash or card),

- In-person from a peer.

Buying bitcoin with verification

- Online exchanges that accept fiat money (Bitstamp, Kraken, Coinmate),

- Lightning exchanges, e.g. ZAP Olympus (beta).

The KYC process poses very serious risks that should not be taken lightly by the average user. And before he voluntarily undergoes them, he should carefully weigh all the pros and cons. This topic is discussed in more detail in Chapter 11 of this article: Decentralized P2P exchange Bisq - How to buy and sell bitcoin correctly? (GUIDE)

Earning Bitcoin

The best way to get bitcoin is to earn it: exchange your time, effort, and skills for bitcoin. There aren't many such options yet, but if you have a unique skill, if you're an expert in the field, and if businesses can't do without you, chances are you'll be in a position to get paid in bitcoin if you insist.

By exchanging your time and effort directly for bitcoin, you will cleverly avoid the complicated process of buying bitcoin. You will be selling your time and effort for one of the rarest commodities on planet Earth, which can be assumed to grow in value in the long run, and not only in financial terms.

In addition to Alza, other companies offer bitcoin remuneration as well. These are mainly the more progressive ones or those whose business model is based directly on bitcoin. You can take a look at jobs at TopMonks, SatoshiLabs, Braiins, or Paralelni Polis.

Bitcoin as a Payment Method

In addition to working for bitcoin, you can also accept bitcoin as a payment method, meaning you can sell your goods and services directly for bitcoin. There are many ways to accept bitcoin. We recognize the two main types to do so:

- We truly receive bitcoin, i.e. we hold our private keys. Check out BTCPay Server.

- We use third-party services, which do all the heavy lifting for us and we receive fiat, not bitcoin (OpenNode, Confirmo)

Accepting bitcoin via the first option is not easy. You need to consider whether you can afford the risk of exchange rate fluctuations and sometimes a very long bear market. It is even riskier for large companies, as these have to pay suppliers and their employees, so companies usually opt for third-party services that abstract bitcoin away (the recipients get fiat at their end of the transaction).

Bitcoin Mining

Bitcoin can also be mined, but the times when anyone could mine on an average laptop are long gone. Bitcoin is mined using specialized ASIC equipment: chips manufactured for a single purpose of SHA256 hashing. ASIC miners are expensive, incredibly noisy, and quite risky from a financial perspective.

Alternatively, altcoins can be mined on GPU rigs, and then exchanged for bitcoin. But even altcoin mining is not a simple matter and the return on investment is uncertain. In any case, avoid cloud mining and all services that sell or rent hashrate. It is almost always a fraud, and if not, it is most likely a guaranteed loss-making affair.

How and Where to Pay With Bitcoin?

Although it may not be obvious at first glance, bitcoin is accepted in a lot of places and you can buy many things for bitcoin. Businesses and individuals are increasingly accepting bitcoin, some even do so via the Lightning Network.

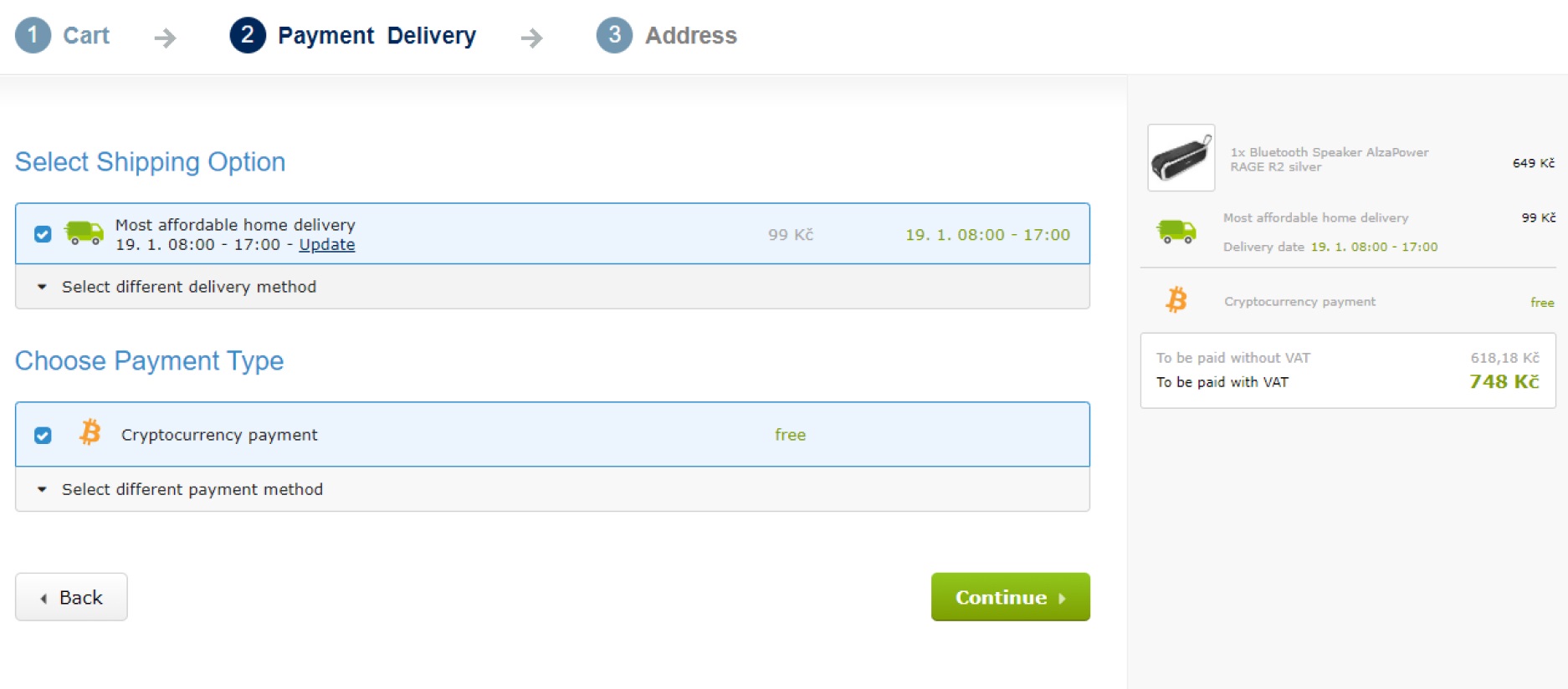

Bitcoin payments on Alza

On Alza, you can buy a wide range of goods from electronics through durable food, cosmetics, literature, home and garden equipment to toys, sports equipment, drugstores, and even cars (when referring to the Czech website). You can pay for all this with bitcoin. In other words, you can already cover a significant part of your shopping needs with bitcoin.

The second way to pay for goods on Alza, including using the Lightning Network, is Cryptopay. It offers near-zero fees, and unlike regular bitcoin payments, it provides several levels of improved transactional privacy.

Bitcoin Payments Elsewhere

Bitcoin can be used for indirect payments almost anywhere and for almost anything. You just need to look for various ways to do it. You could, for example, pay for everything with a credit card and pay off the accrued debt with bitcoin using a service like Cryptopay. Thus if you have the financial discipline and manage to settle your credit card balance on time, you can happily buy everything you need with bitcoin.

i

Did you know that you can use Cryptopay to send CZK/EUR/USD to any current bank account in the Czech Republic?

But you can also use this unique service to pay for any purchase, utility bill, or send regular money to anyone's bank account while paying with bitcoin.

If you have the financial discipline and manage to settle your credit card balance on time, you can happily buy everything you need on your credit card and settle the balance at the end of the month via Cryptopay using a bitcoin payment.

Bitcoin Payments Using Gift Cards

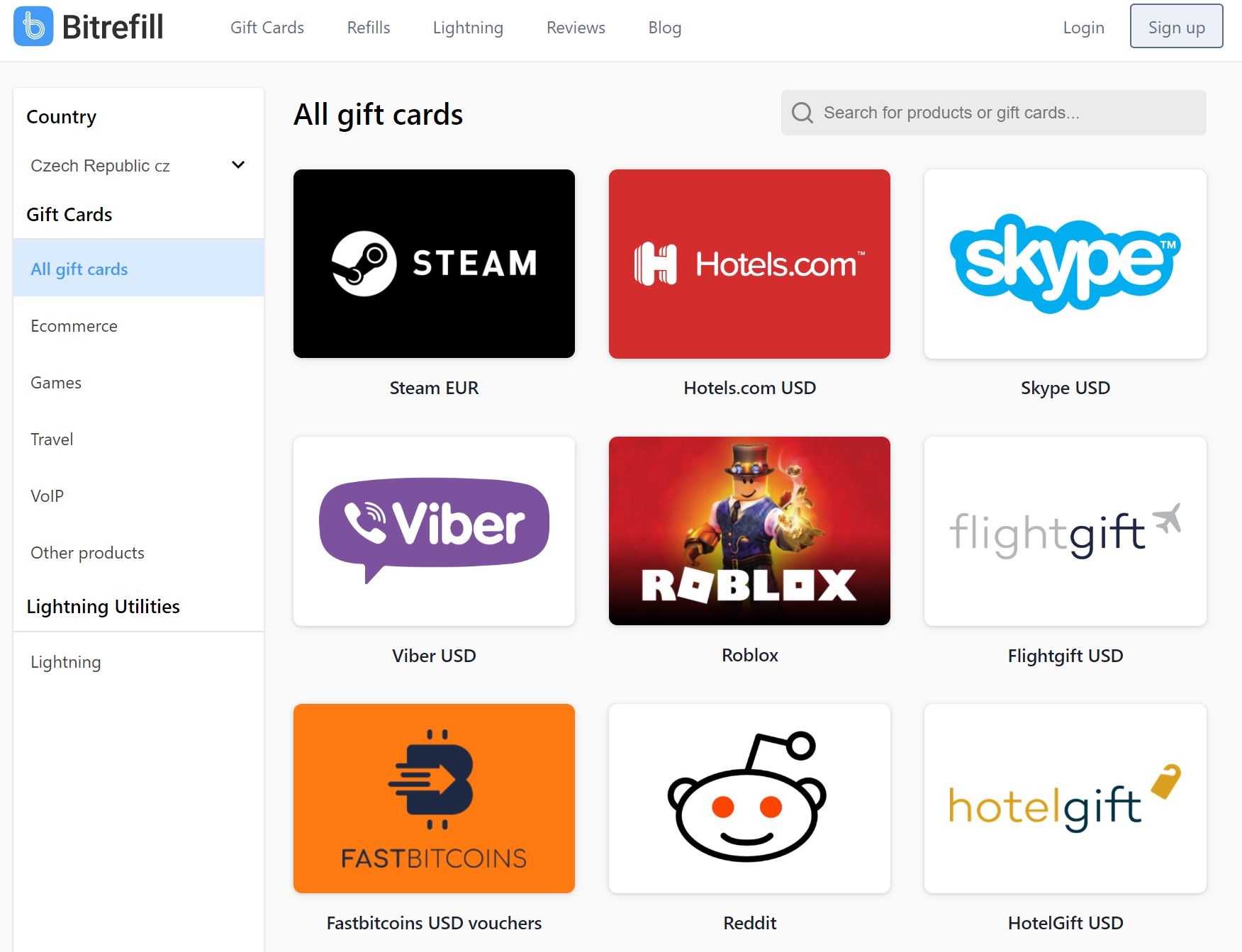

One of the most widely used ways to pay with bitcoin for goods and services is to purchase gift cards. You simply buy a gift card for bitcoin and then redeem it at the merchant.

Through Bitrefill, you can buy games and software, as well as hotel accommodation or airline tickets.

Shopping with discounts

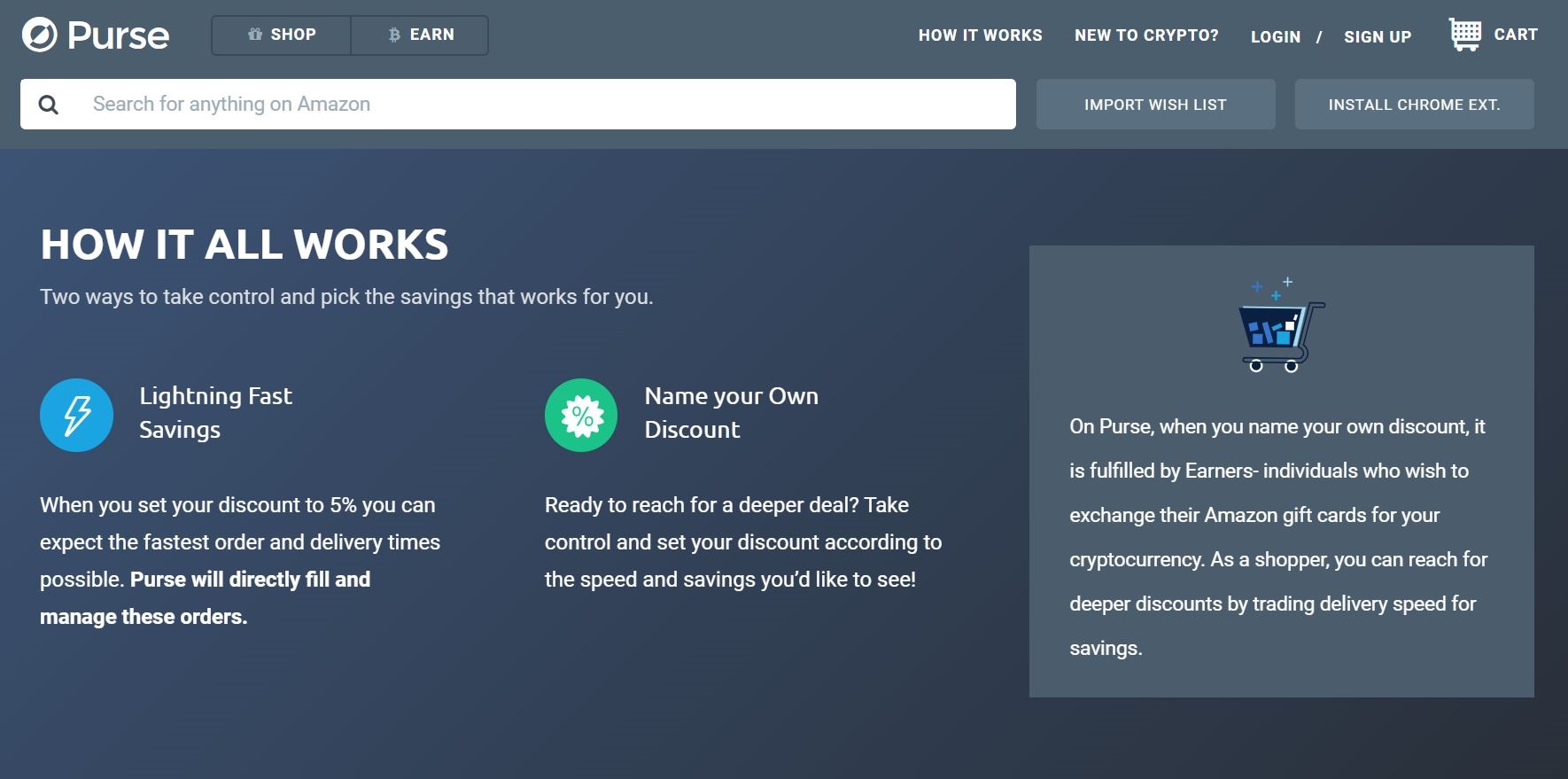

The Purse.io platform is also very interesting. It juxtaposes supply and demand for the purchase of goods on Amazon. On the supply side, there are people with gift cards who have nothing to spend it on and would rather welcome to redeem the cards for money. On the demand side, there is someone who needs to buy stuff off Amazon and would like to pay for bitcoins.

Purse.io is one of the first platforms to truly reflect Bitcoin’s scarcity. Bitcoin is deflationary and is scarcer than any government-issued money, so people are willing to pay a premium for bitcoin. Purse works simply by choosing the thing you want to buy from Amazon with a certain percentage discount, for example, 30%. If there is a person on the platform who wants to get bitcoins in exchange for his gift card, he will pay for your order on Amazon and you will pay him in bitcoins with a 30% discount through Purse.

i

Bitcoin University

Bitcoin is fascinating for its multidisciplinarity: We can analyse it from the point of view of cryptography, mining, economics or practical guidelines. At Alza, we regularly feature articles that take our understanding of Bitcoin to the next level, as well as yours. From recent times we recommend in particular the following articles:

What Is Bitcoin Mining and Is It Really Causing an Environmental Disaster?

What Is the Current Bitcoin Exchange Rate?

After several bear markets and constant price fluctuation, the price of bitcoin has risen to almost dizzying heights. No one can predict with certainty the future price levels, but many will keep trying. However, we already know that bitcoin is an unprecedented attempt at decentralized non-state money, and after more than a decade of existence, bitcoin is doing very well. You can follow the current exchange rate and its recent development on the Coinmarketcap website.

- Currency: Bitcoin

- Ticker: BTC

- Block time: 10 minutes

- Launch date: January 3rd, 2009

- Total amount in circulation: 21 million

- Current amount in circulation: 18.5 million

- Community: https://www.reddit.com/r/Bitcoin/

- Official website: https://bitcoin.org/en/

- Github:https://github.com/bitcoin/

Current Bitcoin Exchange Rate

We often read about a cryptocurrency that supposedly surpasses bitcoin. It was, however, bitcoin that paved the way for these other currencies; and to this day, bitcoin remains unsurpassed and remains the leader in terms of community, number of full nodes, transaction volume, and high-quality developers. The true meaning of bitcoin is only gradually being discovered by the world - and it is never too late for anyone to dive into bitcoin.

Bitcoin (All you need to know): Authors

Josef Tětek

Josef is an economist and analyst influenced by the Austrian school of economics. He works as an analyst at TopMonks and is a fellow at the Czech Liberal Institute. Co-author of the paper Bitcoin Peer Banking. Author of Bitcoin: Separation of Money and State. @SatsJoseph on Twitter.

Aleš Janda

Aleš has been a bitcoin enthusiast since 2010. From 2011, he enjoyed meeting people for in-person trading - until 2014, when fraudsters began laundering money through him. In 2013, he solved the theft of bitcoins from the then Bitcash.cz marketplace. Based on the findings of the research, he then created the first page that was able to trace bitcoins: WalletExplorer.com. Since 2015, he has been working as an analyst and researcher for the cryptocurrency tracing company Chainalysis, where he researches exactly how the transactions of various cryptocurrencies work and what can be read from them. He occasionally assists the police in detecting cryptocurrency fraud, and is an active member of the Institute of Cryptoanarchy in the Parallel Polis.

Michal Mikle

I'm an overclocker and enthusiast Bitcoiner. With computer hardware, any unused performance won't keep me calm. If there is the possibility of squeezing another drop of power from the hardware, I won't miss it. I love the adrenaline and pushing the limits, of the components and myself. This activity is rich with choices, but I mainly use liquid nitrogen and phase-change methods. I also set up a service to optimise Intel processors, delid.cz, building custom PC setups on demand and I enjoy security and privacy topics. Outside the digital world I'm interested in permaculture and other low time preference systems.